Introduction

Creating compelling banking advertisements can feel overwhelming for financial institutions trying to connect with their audience. It’s a common struggle, one that many face as they seek to convey their message clearly and authentically. The implications of not resonating with potential clients can be significant - missed opportunities, lost trust, and a disconnect that can be hard to bridge.

But there’s hope. By focusing on essential elements like clarity, emotional appeal, and trustworthiness, banks can craft messages that truly resonate. Imagine a world where your advertisements not only capture attention but also foster loyalty among clients. This is achievable through leveraging data-driven insights and innovative strategies.

At RNO1, we understand the emotional landscape of your audience. We’re here to support you in enhancing engagement and transforming viewers into loyal customers. Let’s work together to create advertisements that not only speak to the heart but also drive results.

Define Core Elements of Effective Banking Ads

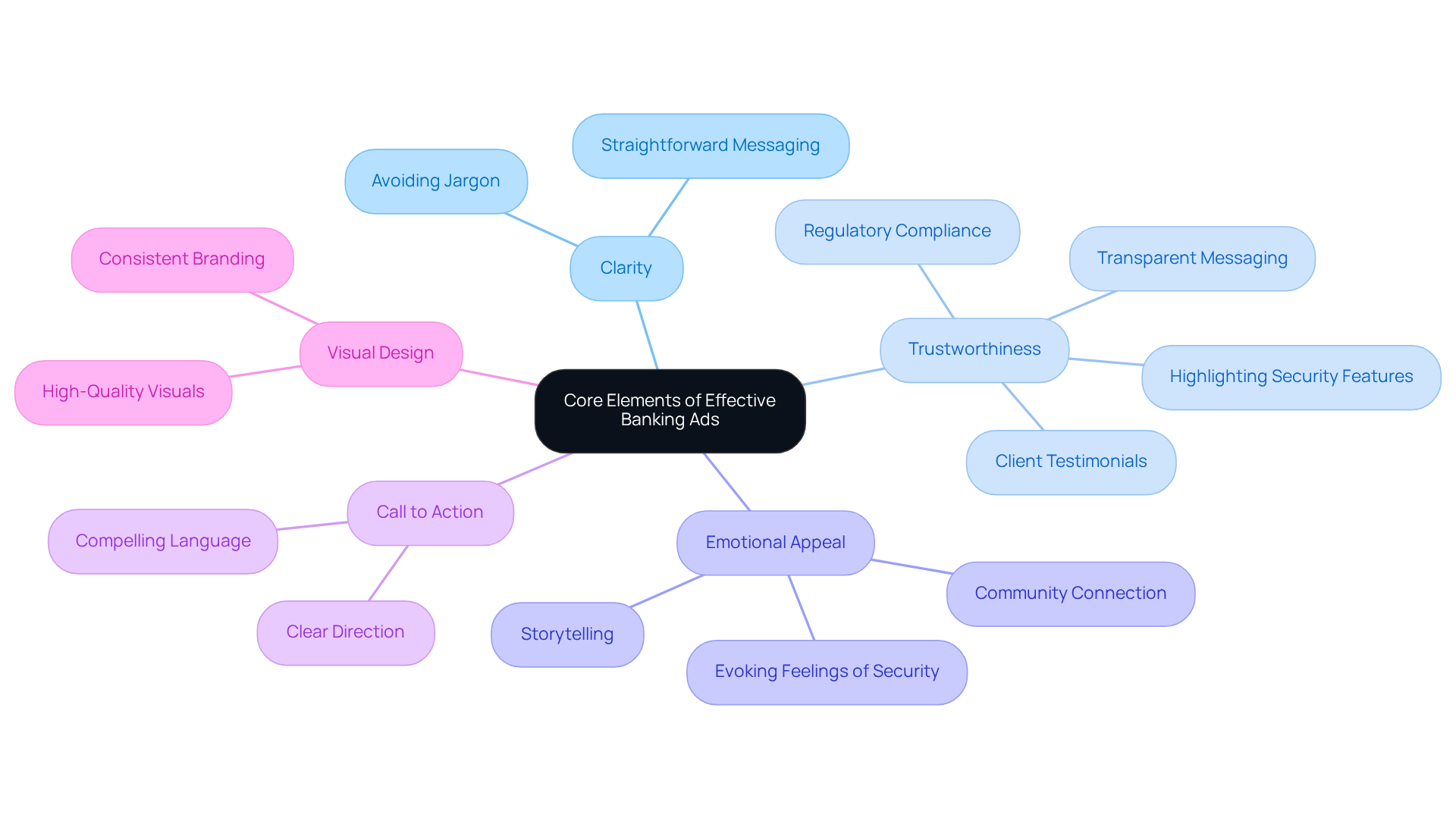

Creating effective banking ads can be overwhelming, particularly when attempting to connect with your audience. It’s crucial to define core elements that truly resonate with them. Here are some key aspects to consider:

-

Clarity: It’s so important to ensure that your message is straightforward and easy to grasp. Avoiding jargon and complex terms can help prevent confusion for potential clients, making them feel more at ease.

-

Trustworthiness: Building trust is essential. Transparent messaging can go a long way. Highlighting security features, sharing client testimonials, and showcasing regulatory compliance can reassure clients about their financial safety, which is a top concern for many.

-

Emotional Appeal: Think about how storytelling can connect you emotionally with your audience. Ads that evoke feelings of security, success, or community can significantly enhance engagement. Sharing relatable stories can make your message more impactful.

-

Call to Action (CTA): A strong CTA is your guiding light. It should clearly direct the audience on what to do next, whether it’s visiting a website, signing up for a service, or reaching out to a representative. Make it compelling and easy to follow.

-

Visual Design: High-quality visuals that align with your brand identity are vital. Consistent branding across all platforms not only reinforces recognition but also builds trust with your audience.

By focusing on these fundamental aspects, financial institutions can create banking ads that not only capture interest but also nurture relationships, transforming viewers into loyal clients. Remember, it’s about connecting on a deeper level and showing that you genuinely care.

Utilize Data-Driven Insights for Optimization

In today’s fast-paced world, many banks struggle to connect with their audiences through advertising. This disconnect can lead to missed opportunities and frustration for both the institutions and their clients. But there’s hope! By embracing data-driven insights, banks can transform their advertising strategies and foster deeper connections with their customers.

Audience Segmentation is a vital first step. By utilizing data analytics, banks can segment their audience based on demographics, behaviors, and preferences. Imagine crafting ads that speak directly to the unique needs of each group - this tailored approach not only boosts engagement but also shows clients that their individual needs matter.

Next, let’s talk about Performance Metrics. Regularly monitoring key performance indicators (KPIs) like click-through rates (CTR), conversion rates, and client acquisition costs is essential. Analyzing these metrics can feel overwhelming, but it’s a crucial part of understanding what resonates with your audience and what doesn’t. This insight can guide your future efforts and help you avoid the pitfalls of ineffective advertising.

A/B Testing is another powerful tool. By comparing different ad variations - like headlines, images, and calls to action - you can discover which combinations truly connect with your audience. It’s all about finding that sweet spot that drives results.

Don’t forget about Feedback Loops. Establishing mechanisms to gather insights from clients about their experiences with your ads can be incredibly valuable. This feedback not only enhances your messaging but also strengthens your targeting approaches, making clients feel heard and valued.

Lastly, consider Predictive Analytics. This proactive method allows financial institutions to forecast trends and customer behaviors, helping them stay ahead of market changes. By adapting advertising tactics accordingly, banks can ensure they’re meeting their clients’ evolving needs.

By embracing these data-informed strategies, financial institutions can enhance their advertising efficiency and achieve remarkable outcomes. Together, let’s create a more connected and understanding banking experience.

Incorporate Innovative Digital Strategies

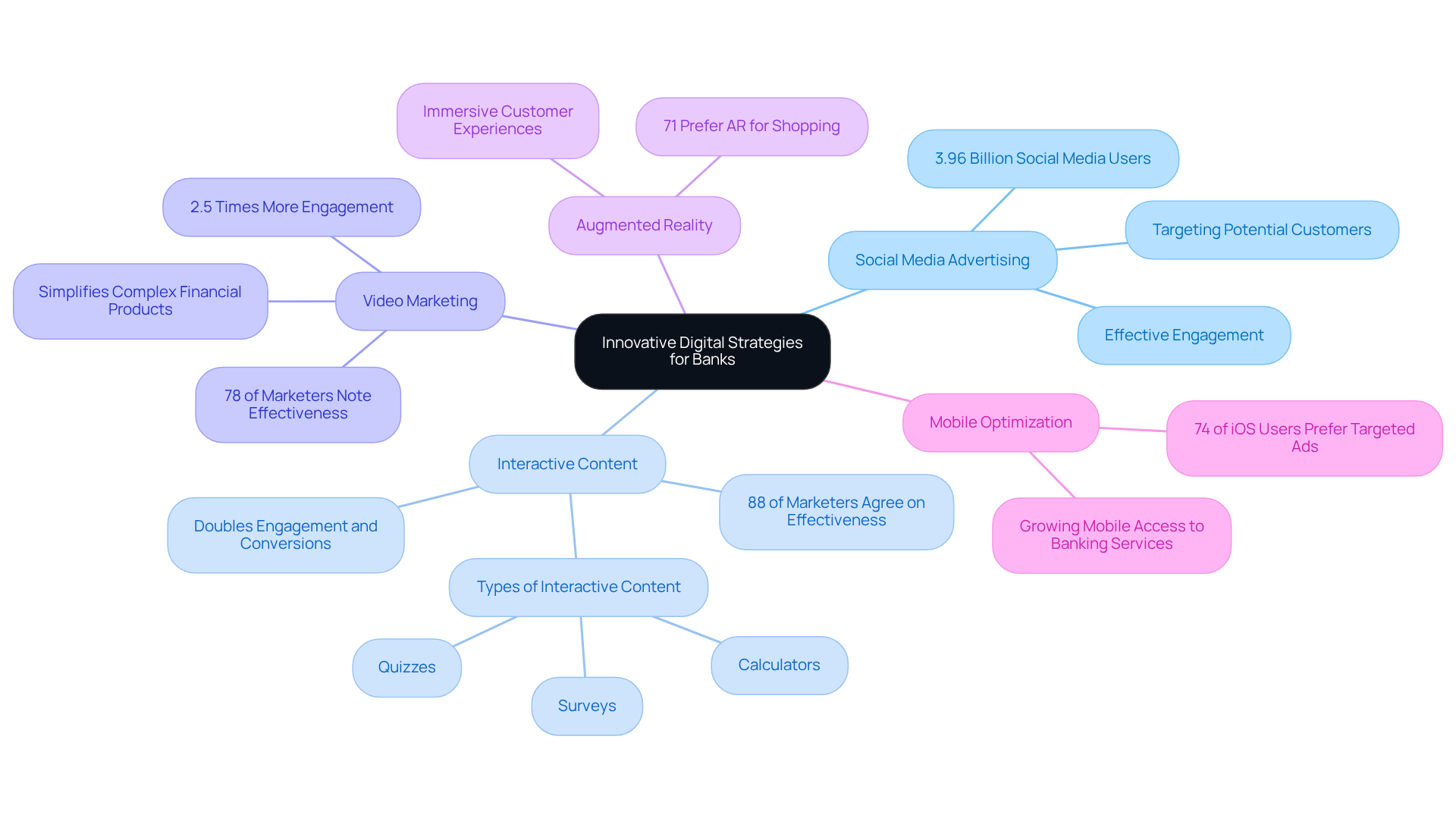

In today’s fast-paced world, banks face a pressing challenge: how to remain competitive in an ever-evolving digital landscape. It’s not just about keeping up; it’s about truly connecting with customers in meaningful ways. As we navigate this complex environment, let’s explore some innovative banking ads that can help banks foster deeper relationships with their audiences.

-

Social Media Advertising: Imagine reaching out to potential customers where they already spend their time - on platforms like Facebook, Instagram, and LinkedIn. By tailoring content to fit the unique characteristics of each platform, banks can engage a wider audience. With over 3.96 billion social media users globally, effective targeting can significantly enhance engagement and create a sense of community.

-

Interactive Content: Think about how engaging it would be for customers to interact with ads that offer personalized insights, like quizzes or calculators. This not only fosters deeper connections but also encourages sharing. In fact, 88% of marketers agree that interactive content helps brands stand out. Plus, it generates twice as many conversions compared to passive content, making it a vital part of modern advertising strategies.

-

Video Marketing: Visual storytelling can be a powerful tool. Utilizing video content to clarify complex financial products can simplify information and increase viewer retention. Did you know that videos generate 2.5 times more engagement than text-based posts on social media? This statistic highlights the importance of incorporating video into banking ads to effectively capture the attention of the audience.

-

Augmented Reality (AR): Imagine creating immersive experiences that allow users to visualize banking products in real life. AR technology can significantly boost consumer engagement, with 71% of individuals preferring to shop with AR for informed purchasing decisions. By leveraging AR, banks can transform customer interactions and spark interest in their offerings.

-

Mobile Optimization: In a world where smartphones are ubiquitous, ensuring that all ads are optimized for mobile devices is crucial. With a growing number of consumers accessing banking services via their phones, mobile-friendly ads can capture attention effectively. In fact, 74% of iOS users prefer opting into targeted ads rather than paying for currently free features.

By embracing these creative approaches, financial institutions can improve their promotional effectiveness with banking ads and also build stronger connections with their audiences. Let’s work together to navigate these challenges and create a supportive environment for growth.

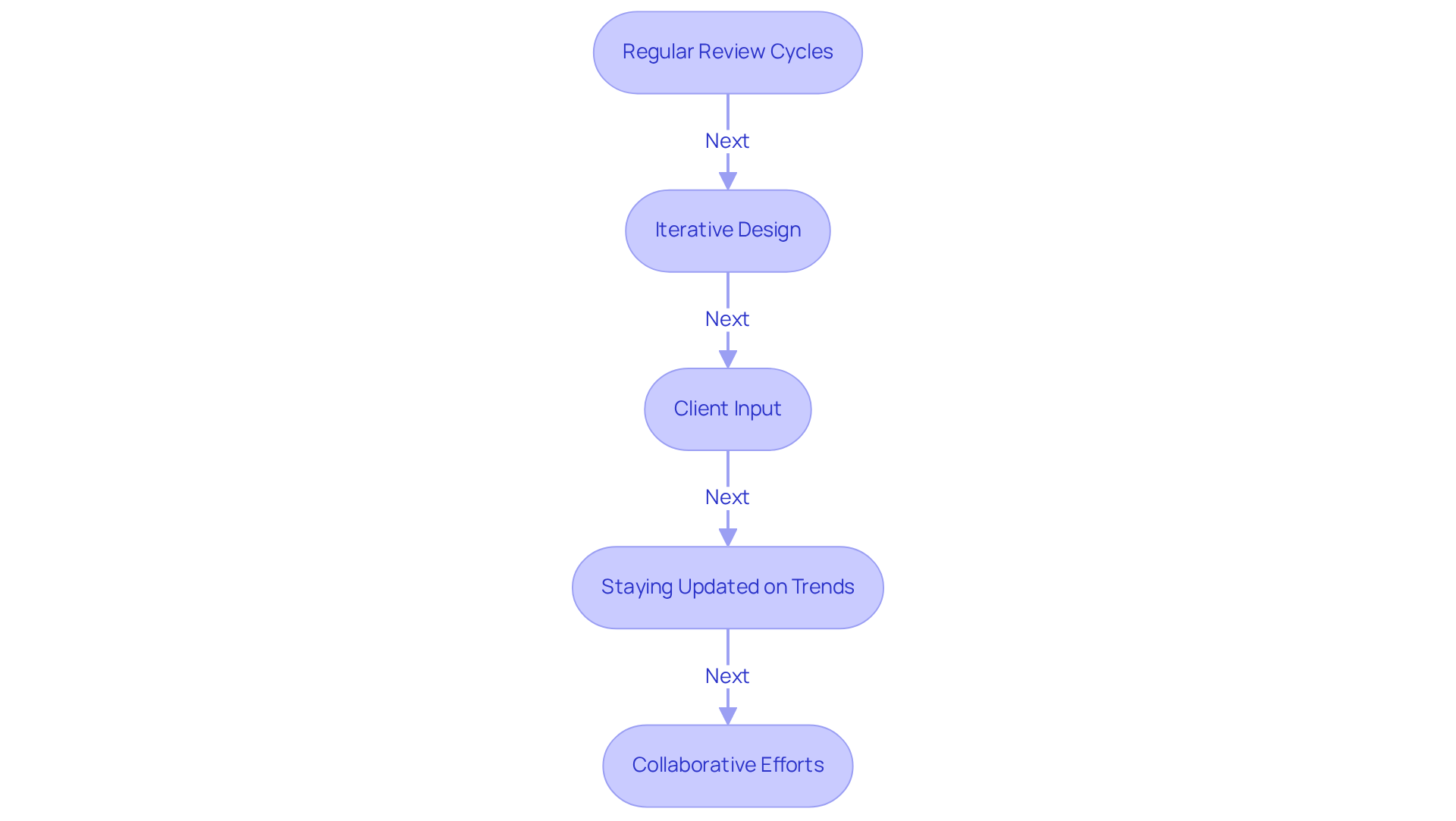

Implement Continuous Testing and Iteration

In the fast-paced world of banking, ensuring the effectiveness of your advertising can feel overwhelming. Many financial institutions struggle to keep their ads relevant and impactful, which can lead to missed opportunities and frustrated clients. This is a common challenge, but it’s one that can be addressed with a nurturing approach.

To tackle this issue, consider implementing continuous testing and iteration in your advertising strategies. Start with Regular Review Cycles. Establish a routine for reviewing ad performance metrics. Regular assessments not only help identify trends but also highlight areas for improvement. For example, many banks are now focusing on first-party data strategies to enhance ad targeting, which can significantly boost campaign effectiveness.

Next, embrace Iterative Design. This means adopting a flexible approach where ads are continuously refined based on performance data and client feedback. Think of it as a conversation with your audience. As Cornelia Reitinger points out, AI can revolutionize campaign creation by dynamically producing ad variations based on client insights, illustrating the beauty of this iterative process.

Don’t forget the importance of Client Input. Actively seek feedback through surveys or focus groups. Understanding client perceptions can guide your future ad development. Lisa Nicholas emphasizes that financial institutions should prioritize privacy-first targeting and AI-driven personalization to achieve measurable outcomes. This underscores the significance of listening to your clients.

Staying updated on industry trends is also crucial. By keeping abreast of emerging technologies, you can adapt and find fresh opportunities for engagement. For instance, over 60% of digital banking users believe that AI will significantly alter their banking experience in the next five years. This shift is something banks must embrace to stay relevant.

Lastly, foster Collaborative Efforts. Encourage collaboration between marketing, sales, and customer service teams. Sharing insights across departments can lead to more cohesive and effective advertising strategies. By successfully integrating new technologies and data, financial institutions can better capture and convert digital audiences.

By implementing these continuous testing practices, banks can ensure their advertising remains relevant and effective in a dynamic market. Remember, it’s about nurturing relationships and understanding the needs of your clients. Together, we can create a more engaging and supportive banking experience.

Conclusion

Creating effective banking ads can feel overwhelming, can’t it? Many financial institutions struggle to connect with their audience, often leaving potential clients feeling unheard or unvalued. This disconnect not only affects engagement but can also hinder the development of lasting relationships.

By prioritizing clarity, trust, emotional connection, and strong calls to action, banks can truly resonate with their audience. Imagine crafting advertisements that not only inform but also foster a sense of belonging and loyalty. This is where the journey begins, and it’s one that can lead to meaningful connections with clients.

Key insights reveal that leveraging data-driven strategies for audience segmentation, performance monitoring, and continuous testing is essential. Innovative digital tactics - like social media advertising, interactive content, and video marketing - can significantly enhance engagement and effectiveness. These methods allow banks to reach out in ways that feel personal and relevant, making clients feel valued and understood.

Moreover, embracing a culture of feedback and iterative design empowers banks to adapt and refine their advertising efforts. This adaptability is crucial in a rapidly changing landscape, ensuring that institutions remain relevant and responsive to customer needs.

Ultimately, the journey to create impactful banking ads is ongoing. By committing to these best practices and staying attuned to customer needs and industry trends, banks can improve their advertising outcomes. More importantly, they can contribute to a more connected and supportive banking experience. Embracing these strategies will not only help institutions navigate the complexities of modern advertising but will also lead to greater success in reaching and engaging their target audiences. Together, we can create a banking environment that truly cares.

Frequently Asked Questions

What are the core elements of effective banking ads?

The core elements of effective banking ads include clarity, trustworthiness, emotional appeal, a strong call to action (CTA), and visual design.

Why is clarity important in banking ads?

Clarity is important because it ensures that the message is straightforward and easy to understand, avoiding jargon and complex terms that could confuse potential clients.

How can trustworthiness be established in banking ads?

Trustworthiness can be established through transparent messaging, highlighting security features, sharing client testimonials, and showcasing regulatory compliance to reassure clients about their financial safety.

What role does emotional appeal play in banking ads?

Emotional appeal plays a significant role by connecting with the audience through storytelling that evokes feelings of security, success, or community, enhancing engagement with the ad.

What should a strong call to action (CTA) accomplish in a banking ad?

A strong CTA should clearly direct the audience on what to do next, such as visiting a website, signing up for a service, or contacting a representative, and it should be compelling and easy to follow.

Why is visual design important for banking ads?

Visual design is important because high-quality visuals that align with brand identity reinforce recognition and build trust with the audience, ensuring consistency across all platforms.

How can focusing on these elements benefit financial institutions?

By focusing on these elements, financial institutions can create ads that capture interest and nurture relationships, transforming viewers into loyal clients and demonstrating genuine care.