Introduction

In a world where traditional banks are struggling to stand out against nimble fintech disruptors, the challenge of effective advertising feels more pressing than ever. Many financial institutions find themselves grappling not just with understanding their customers, but also with the complexities of regulatory requirements and the need for digital transformation. This can be overwhelming, leaving banks wondering how to connect meaningfully with today’s consumers.

Imagine a bank that truly understands its clients, one that can tailor its messaging to resonate with their unique needs and preferences. The stakes are high, and the implications of missing the mark can be significant. But there’s hope. By embracing innovative strategies, banks can enhance their advertising efforts and foster lasting relationships with their clients.

This article explores best practices that empower banks to navigate this landscape. From harnessing the power of AI for personalized marketing to leveraging first-party data for deeper client engagement, there are actionable steps that can make a real difference. How can banks adapt their advertising approaches to not only meet the demands of today’s consumers but also build a supportive community around their services? Together, we can explore these solutions and create a brighter future for financial institutions.

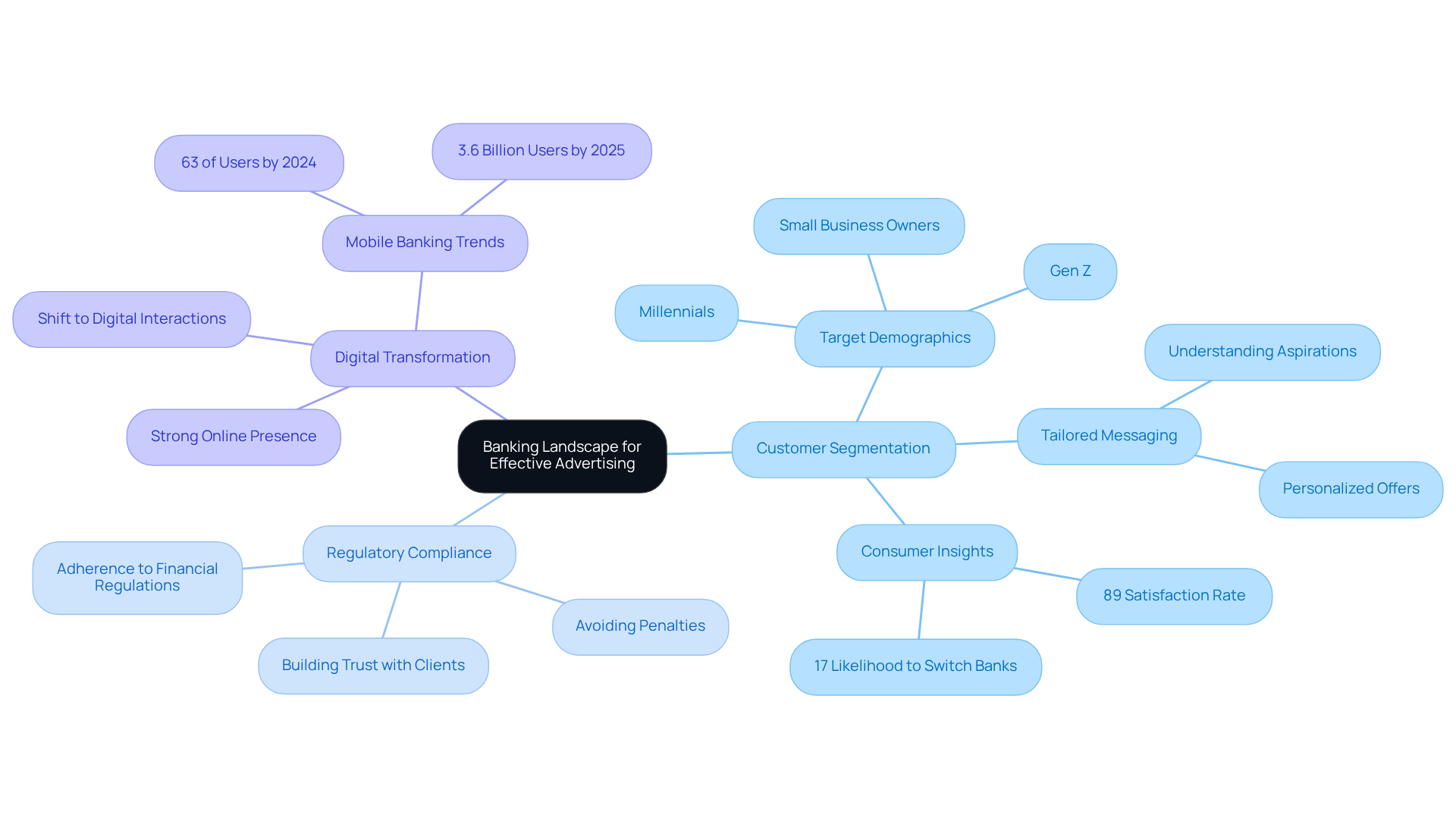

Understand the Banking Landscape for Effective Advertising

In today’s banking sector, understanding the current landscape is more crucial than ever. Banks face the challenge of not only competing with one another but also with innovative fintech companies that are reshaping the industry. This can feel overwhelming, especially when considering the diverse client demographics and the complex regulatory environment.

-

Customer Segmentation is a vital step. By identifying key segments like millennials, Gen Z, and small business owners, banks can tailor their messaging to resonate with these groups’ unique needs and preferences. Imagine a young entrepreneur feeling understood and valued when they see a bank’s advertisement that speaks directly to their aspirations.

-

Next, Regulatory Compliance cannot be overlooked. It’s essential for banks to ensure that all advertising strategies adhere to financial regulations. This not only helps avoid penalties but also fosters trust with clients, who want to feel secure in their financial choices.

-

Finally, the shift towards Digital Transformation is undeniable. As customers increasingly prefer digital interactions over traditional banking methods, having a strong online presence becomes essential. Banks that embrace this change can connect more effectively with their clients, offering them the convenience they seek.

By understanding these factors, financial institutions can enhance their advertising for banks, creating campaigns that are not just relevant but also impactful, fostering deeper connections with their target audiences. Together, we can navigate this evolving landscape and build a banking experience that truly meets the needs of today’s consumers.

Leverage AI to Enhance Digital Marketing Strategies

Artificial Intelligence (AI) is reshaping how financial institutions approach advertising for banks, although this transformation presents its own set of challenges. Many banks struggle to connect with their customers in a meaningful way, leading to missed opportunities and frustration. Imagine a bank that sends generic offers to its clients, leaving them feeling undervalued and disconnected. This is a common pain point that can hinder growth and customer loyalty.

However, by harnessing AI, banks can turn this situation around. AI algorithms analyze vast amounts of customer data, allowing institutions to personalize interactions like never before. This means delivering tailored content and offers that resonate with individual clients, significantly enhancing engagement. For instance, AI-powered product recommendations can boost conversion rates by an impressive 26% and increase repeat purchases by 15%. This not only drives customer loyalty but also fosters a deeper connection between the bank and its clients.

Moreover, AI can help banks optimize their advertising for banks spending. With AI-driven analytics, institutions can assess the performance of their campaigns in real-time, making swift adjustments to maximize return on investment (ROI). This proactive approach ensures that marketing budgets are utilized effectively. Companies leveraging AI for marketing have reported a remarkable 39% increase in revenue and a 39% reduction in costs. McKinsey even projects a 15-20% net cost reduction across the banking industry through AI integration, demonstrating the financial benefits of optimized advertising for banks.

Another significant advantage of AI is its predictive analytics capabilities. By forecasting client behavior and preferences, banks can proactively address client needs, ultimately improving retention rates. Picture an AI chatbot providing instant support, enhancing user experience while freeing up human resources for more complex inquiries. This not only boosts client satisfaction but also leads to a 30% rise in client retention within the first six months of AI onboarding. Additionally, AI decreases service operational costs by 30%, illustrating the efficiency gains from its integration.

By incorporating these AI features, financial institutions can greatly enhance their digital marketing strategies, resulting in better client interactions and continuous growth in a competitive environment. Yet, it’s crucial to acknowledge that 70-85% of AI projects still fail. This statistic highlights the importance of careful implementation to avoid common pitfalls. With the right support and guidance, banks can navigate these challenges and fully realize the potential of AI in their marketing efforts.

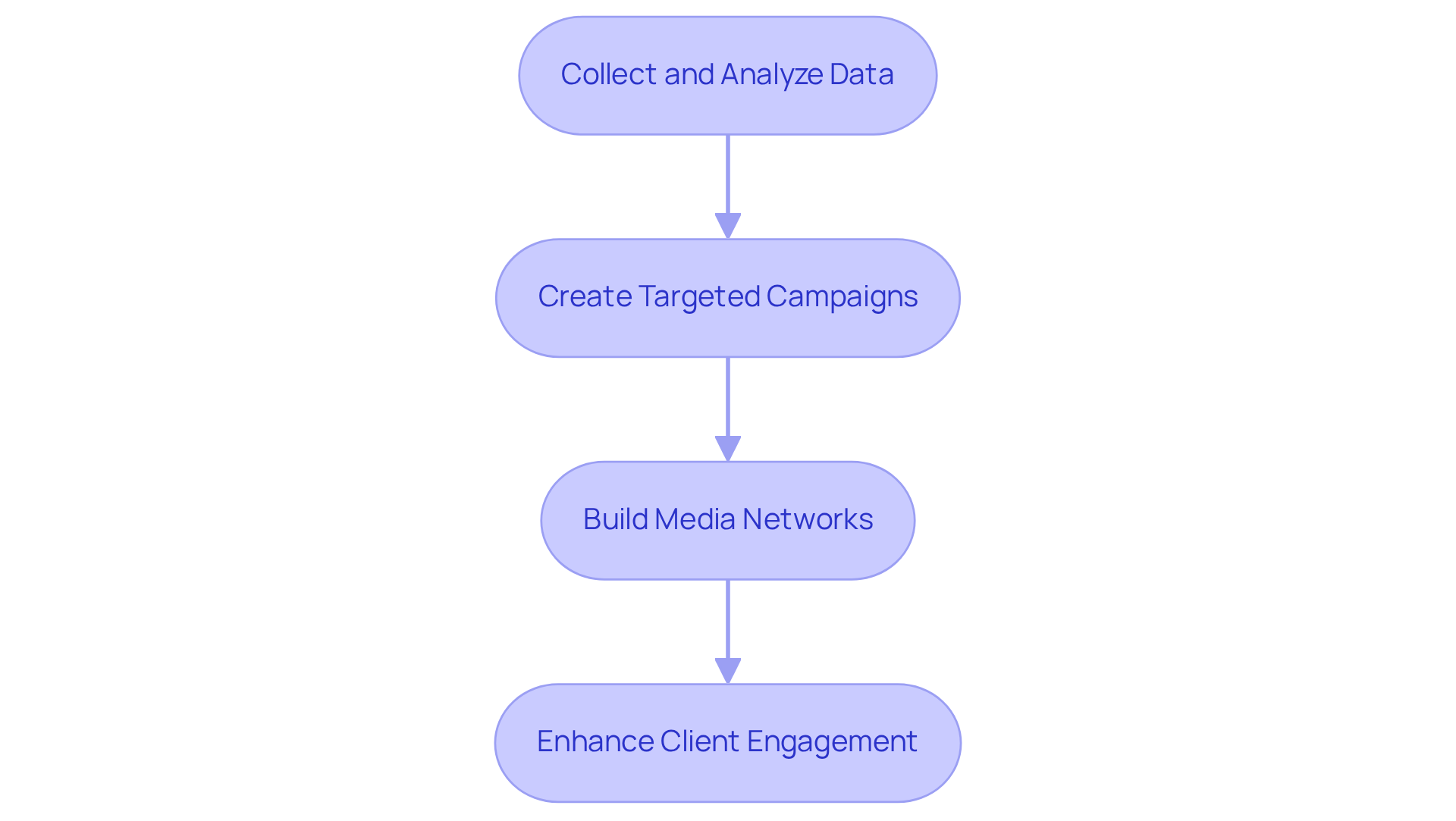

Utilize First-Party Data and Build Media Networks

For financial institutions, the challenge of enhancing advertising for banks can often feel overwhelming. Many struggle to connect with clients in a meaningful way, often leaving them feeling unheard and undervalued. This is where first-party data, gathered directly from clients, becomes a beacon of hope. By focusing on this valuable resource, advertising for banks can truly transform their approach to client engagement.

-

Collect and Analyze Data: Imagine a world where banks understand their clients' behaviors and preferences deeply. Establishing robust systems to gather data from customer interactions across various channels - like online banking, mobile apps, and customer service touchpoints - can make this a reality. This extensive data collection not only assists in advertising for banks to better understand client needs but also fosters operational resilience, ensuring that clients feel valued and understood.

-

Create targeted campaigns in advertising for banks: With insights from first-party data, banks can segment their audiences effectively. Picture tailored marketing messages that resonate with specific client needs and preferences. This personalized approach can significantly enhance engagement and conversion rates in the context of advertising for banks. For instance, by examining transaction trends, financial institutions can offer customized financial solutions that truly connect with individual clients, nurturing strong relationships built on trust and understanding.

-

Build Media Networks: Developing financial media networks that leverage owned digital assets can create additional revenue streams while deepening audience engagement. By curating content that aligns with client interests, banks can improve their advertising for banks, positioning themselves as reliable sources of financial information. This not only solidifies client loyalty but also contributes to operational stability, creating a supportive environment for clients to thrive.

Consider a financial institution that uses its mobile application to provide tailored financial guidance based on user behavior. This thoughtful approach not only enhances client satisfaction but also fosters long-term loyalty. After all, acquiring new clients can be 5 to 25 times more costly than keeping current ones. By focusing on first-party data, banks can create meaningful interactions that lead to sustained growth, ensuring that every client feels valued and supported.

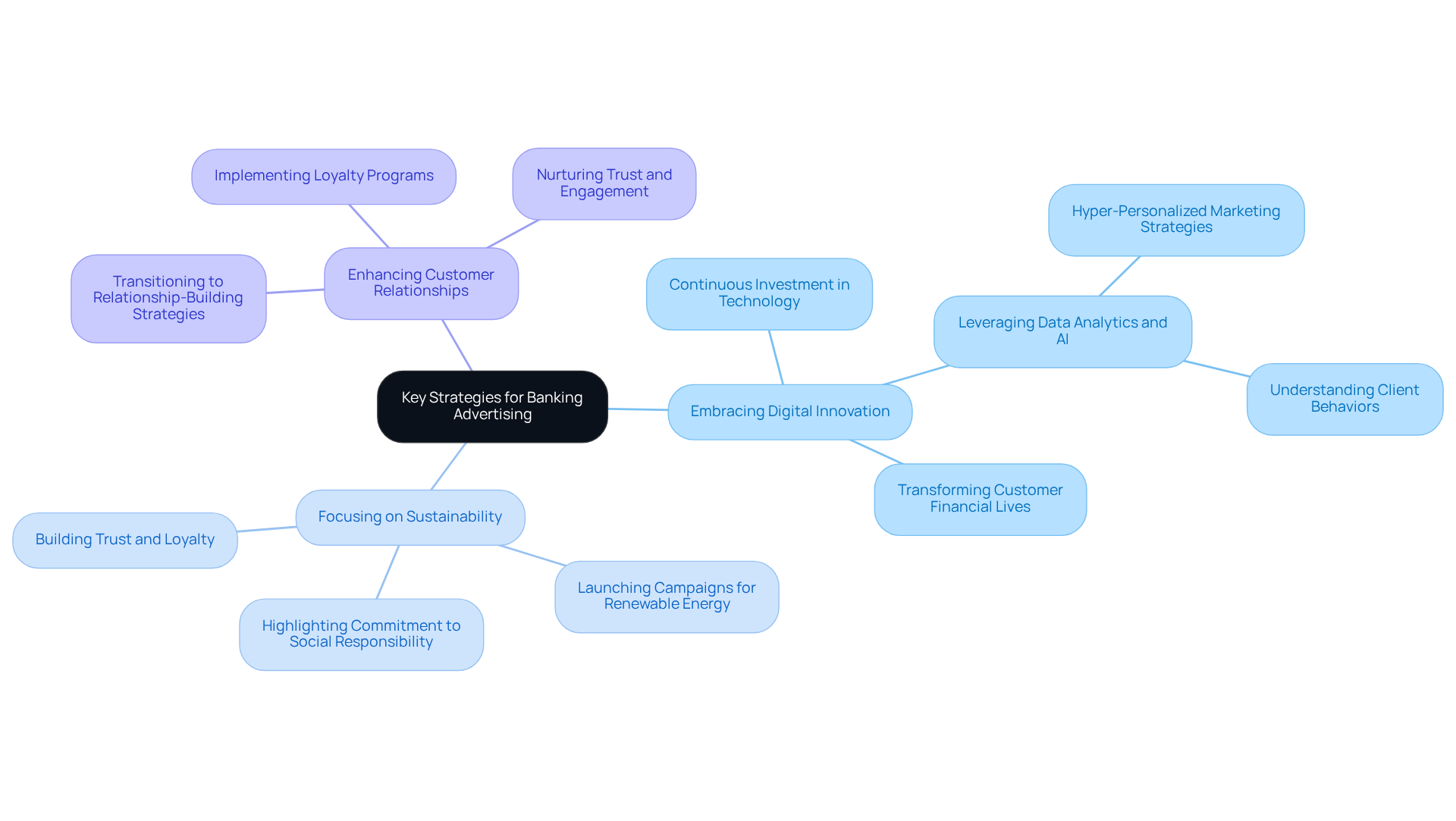

Prioritize Key Strategies for Future Success in Banking Advertising

In the ever-evolving world of banking, institutions face a pressing challenge: how to secure long-term success in advertising amidst changing consumer expectations. This can feel overwhelming, especially as modern consumers increasingly seek connections that resonate with their values.

-

Embracing Digital Innovation is not just a trend; it’s a necessity. Continuous investment in cutting-edge technologies can significantly enhance customer experiences and streamline operations. As the financial landscape shifts, leveraging data analytics and AI becomes crucial. These tools offer valuable insights into client behaviors, enabling banks to craft hyper-personalized marketing strategies that truly connect with individual needs. Harikrishnan B G reminds us that digital banking is about more than just managing finances; it’s about transforming how individuals navigate their financial lives.

-

Focusing on Sustainability is another vital aspect. Today’s consumers are more conscious than ever about sustainability and social responsibility. Banks have a unique opportunity to develop marketing campaigns that highlight their commitment to these principles. For instance, consider a financial institution that recently launched a campaign showcasing its support for renewable energy projects. This initiative not only attracted eco-aware clients but also built trust and loyalty by aligning with consumer values.

-

Enhancing Customer Relationships is essential in this journey. Transitioning from transactional marketing to relationship-building strategies can make a world of difference. By nurturing trust and loyalty through personalized communication and engagement, banks can forge stronger connections with their clients. Implementing loyalty programs and relationship pricing can motivate customers to consolidate their financial services, leading to greater satisfaction. It’s worth noting that approximately 95% of new products fail, underscoring the importance of effective marketing approaches in banking.

By adopting these compassionate strategies, banks can position themselves as industry leaders, adept at navigating changing market dynamics while genuinely meeting the evolving expectations of their consumers. Together, we can create a banking experience that not only meets financial needs but also nurtures relationships and fosters a sense of community.

Conclusion

In the competitive landscape of banking, many institutions struggle to forge meaningful connections with their clients. This challenge can feel overwhelming, especially as the needs of customers continue to diversify. By truly understanding the intricacies of the banking environment, financial institutions can begin to tailor their approaches to meet these varied needs. It’s not just about segmenting audiences based on demographics; it’s also about embracing digital transformation and adhering to regulatory compliance. These steps are essential for building trust and relevance in a rapidly changing world.

The article highlights several key practices that can help banks enhance their advertising efforts:

- Customer segmentation allows for targeted messaging that resonates with specific groups, fostering a sense of belonging.

- Integrating AI can lead to personalized interactions and data-driven insights, optimizing marketing strategies in a way that feels thoughtful and considerate.

- Leveraging first-party data and building media networks can create richer client engagements and open up new revenue streams.

Together, these practices empower banks to navigate the complexities of modern advertising with confidence and care.

As the banking sector continues to evolve, embracing these best practices will be crucial for long-term success. Financial institutions are encouraged to invest in digital innovation and sustainability while prioritizing the development of strong customer relationships. By doing so, banks can not only meet the changing expectations of consumers but also position themselves as leaders in a rapidly transforming industry. The future of banking advertising lies in a commitment to understanding client needs and fostering genuine connections that drive loyalty and growth. Let’s work together to create a banking experience that truly resonates with clients, nurturing relationships that stand the test of time.

Frequently Asked Questions

Why is understanding the banking landscape important for advertising?

Understanding the banking landscape is crucial because banks face competition not only from each other but also from innovative fintech companies. This knowledge helps banks tailor their advertising strategies to meet the diverse needs of their clients.

What role does customer segmentation play in banking advertising?

Customer segmentation is vital as it allows banks to identify key groups, such as millennials, Gen Z, and small business owners. By tailoring messaging to these segments, banks can resonate with their unique needs and preferences, making their advertising more effective.

How does regulatory compliance impact banking advertising?

Regulatory compliance is essential for banks to ensure that their advertising strategies adhere to financial regulations. This helps avoid penalties and fosters trust with clients, who want to feel secure in their financial choices.

What is the significance of digital transformation in banking?

Digital transformation is significant because customers increasingly prefer digital interactions over traditional banking methods. Banks that embrace this shift can strengthen their online presence and connect more effectively with clients, providing the convenience they seek.

How can banks create impactful advertising campaigns?

Banks can create impactful advertising campaigns by understanding customer segmentation, ensuring regulatory compliance, and embracing digital transformation. This approach allows them to develop relevant campaigns that foster deeper connections with their target audiences.