Overview

In today's fast-paced financial world, many individuals find themselves grappling with the complexities of banking. They seek solutions that not only meet their needs but also foster a sense of trust and security. This is where the key innovations in crypto banks come into play. Advancements such as digital asset integration and user-friendly interfaces are designed with the customer in mind, making banking more accessible and efficient. Enhanced security measures further alleviate concerns, ensuring that users feel safe in their transactions.

Moreover, the rise of stablecoins and smart contracts represents a significant step forward in addressing the evolving needs of customers. These innovations are not just technical upgrades; they are essential for building the trust that is so crucial in the financial sector. By improving compliance and accessibility, they pave the way for broader adoption of crypto banking services, ultimately creating a more inclusive financial landscape.

As we navigate these changes together, it’s important to remember that these advancements are here to support you. They aim to create a banking experience that is not only efficient but also nurturing and understanding of your needs. At RNO1, we are committed to being part of this journey, offering solutions that resonate with your experiences and aspirations. Together, we can embrace the future of banking with confidence and care.

Introduction

In a financial landscape increasingly shaped by digital innovation, crypto banks find themselves at the forefront of a transformative wave that holds the potential to reshape traditional banking models. Yet, amidst this evolution, many face significant hurdles.

How can these institutions effectively navigate the complexities of market volatility and regulatory compliance while nurturing trust and loyalty among their clientele?

This article explores seven key innovations that not only enhance customer experiences but also address these unique challenges. As advanced technologies and user-centric solutions continue to integrate, we invite you to reflect on the journey of crypto banks and the promising solutions that can help them thrive.

RNO1: Transforming Crypto Banks with Innovative Digital Experiences

In today's rapidly evolving banking environment, many financial institutions face the daunting challenge of distinguishing themselves in a crowded marketplace. It can be overwhelming to navigate the complexities of digital transformation while trying to connect with customers on a meaningful level. This struggle often leads to frustration and a sense of isolation, as institutions strive to foster loyalty and achieve sustainable growth amidst fierce competition.

At RNO1, we understand these challenges intimately. Our mission is to empower digital financial institutions by crafting radical digital experiences that cater to their unique needs. By employing sophisticated UX design principles and performance marketing tactics, we help our partners build a strong online presence that resonates with their target audience. This innovative approach not only enables institutions to stand out but also nurtures customer relationships, fostering loyalty that is essential for long-term success.

As the demand for customized financial solutions continues to rise, RNO1 stands as a compassionate ally for crypto banks. We are dedicated to enhancing digital experiences, ensuring that our partners can thrive in the ever-changing financial landscape. Together, we can navigate these challenges and create a future where financial institutions not only survive but flourish, connecting deeply with their customers and building lasting relationships.

Revolut Bank: Seamless Fiat-to-Crypto Exchange Services

Navigating the world of fiat-to-crypto exchanges can often feel overwhelming for many individuals. The complexities of traditional currencies versus cryptocurrencies can create confusion and anxiety, leaving potential investors feeling lost. This is where Revolut Bank steps in with its user-centric approach, offering a platform designed to alleviate these concerns.

By providing a highly intuitive interface and real-time exchange rates, Revolut allows customers to transition effortlessly between currencies, making the trading process not only simpler but also more accessible. This innovation opens the door for a wider audience to explore digital currency investments without the usual barriers.

As the digital finance landscape continues to evolve, Revolut's commitment to creating a user-friendly experience positions it as a compassionate ally in transforming how people engage with digital assets. Together, we can embrace this exciting journey into the future of finance.

JPMorgan Chase: Leading the Charge in Crypto Integration

In today's rapidly evolving financial landscape, many individuals and businesses face the challenge of integrating cryptocurrency into their experiences with crypto banks. This can often lead to confusion and frustration as they seek more efficient solutions for their transactions. JPMorgan Chase is stepping up to address this concern by spearheading the integration of crypto banks within traditional banking frameworks. The introduction of JPM Coin is a pivotal step designed to enable instantaneous transactions between clients, streamlining operations and enhancing efficiency. This initiative not only positions JPMorgan as a leader in the digital asset landscape but also underscores its commitment to innovation, aligning it with the evolving role of crypto banks in response to changing economic demands.

Jamie Dimon, CEO of JPMorgan, expresses a strong belief in the potential of stablecoins and blockchain technology, emphasizing that these innovations align with customer needs for more effective financial solutions. As the cryptocurrency market continues to flourish, recently reaching a valuation of $4 trillion, JPMorgan's proactive strategy aims to transform financial norms and expand its market share in crypto banks and services.

Looking ahead, the anticipated launch of JPM Coin in 2025 is expected to significantly impact the financial sector, paving the way for broader adoption of crypto banks and potentially changing how monetary transactions are conducted. Additionally, the collaboration with Coinbase will allow Chase clients to connect their accounts directly to Coinbase wallets and redeem credit card rewards for USDC starting in 2026. This further integration of digital assets into everyday financial transactions not only enhances convenience but also fosters a sense of community among users navigating this new financial frontier.

FV Bank: Prioritizing Security and Compliance in Crypto Banking

In today's digital banking landscape, security and compliance are more than just buzzwords; they are essential for fostering trust. Many customers worry about the safety of their personal information, especially in the volatile crypto market. With a staggering 95 percent of data breaches stemming from human error, this concern is not unfounded. At FV Bank, we understand these fears and are dedicated to implementing comprehensive measures to protect customer data while adhering to ever-evolving regulatory standards. This commitment not only alleviates the risks associated with potential breaches but also nurtures a trusting relationship with our clients, which is crucial for attracting and retaining customers.

As the landscape of cryptocurrency transactions and crypto banks becomes increasingly complex, the importance of compliance cannot be overstated. Recent insights reveal that 81% of bankers anticipate heightened cybersecurity threats driven by geopolitical tensions. In light of this, FV Bank's proactive approach positions us as a supportive leader in the sector. Our CEO, Miles Paschini, reassures customers that they can settle with merchants instantly while feeling secure in their transactions.

Moreover, we are excited to introduce our upcoming custody service, designed specifically for significant cryptocurrencies, catering to the needs of crypto banks. This initiative will not only enhance our compliance practices but also provide an additional layer of protection for our clients. At FV Bank, we are committed to being a reliable ally in the digital finance sector, ensuring that our customers feel supported and secure every step of the way.

Goldman Sachs: Pioneering Digital Asset Strategies

Goldman Sachs is leading the way in digital asset strategies, offering clients a unique opportunity to access cryptocurrency investments. The establishment of a specialized digital currency trading desk in 2025 marks a significant milestone, reflecting the institution's commitment to integrating blockchain technology into its services. Mathew McDermott, the Global Head of Digital Assets, has highlighted the necessity of regulatory clarity, noting that it will encourage capital inflow from major financial institutions and broaden their digital asset trading activities, including the exploration of crypto banks and tokenization. This proactive stance not only enriches Goldman Sachs' service offerings but also symbolizes a growing acceptance of cryptocurrencies within traditional finance.

As the market continues to evolve, the institution's emphasis on tokenization and collateral liquidity operations positions it as a key player in the digital asset landscape, responding to the increasing demand from clients eager to participate in cryptocurrency trading. Yet, contrasting viewpoints persist, as illustrated in the case study 'Sparking Debate,' which underscores ongoing discussions about the legitimacy and future of cryptocurrency.

For tech startup founders, grasping these dynamics is essential as they navigate the shifting terrain of digital assets and contemplate how to harness these opportunities for growth.

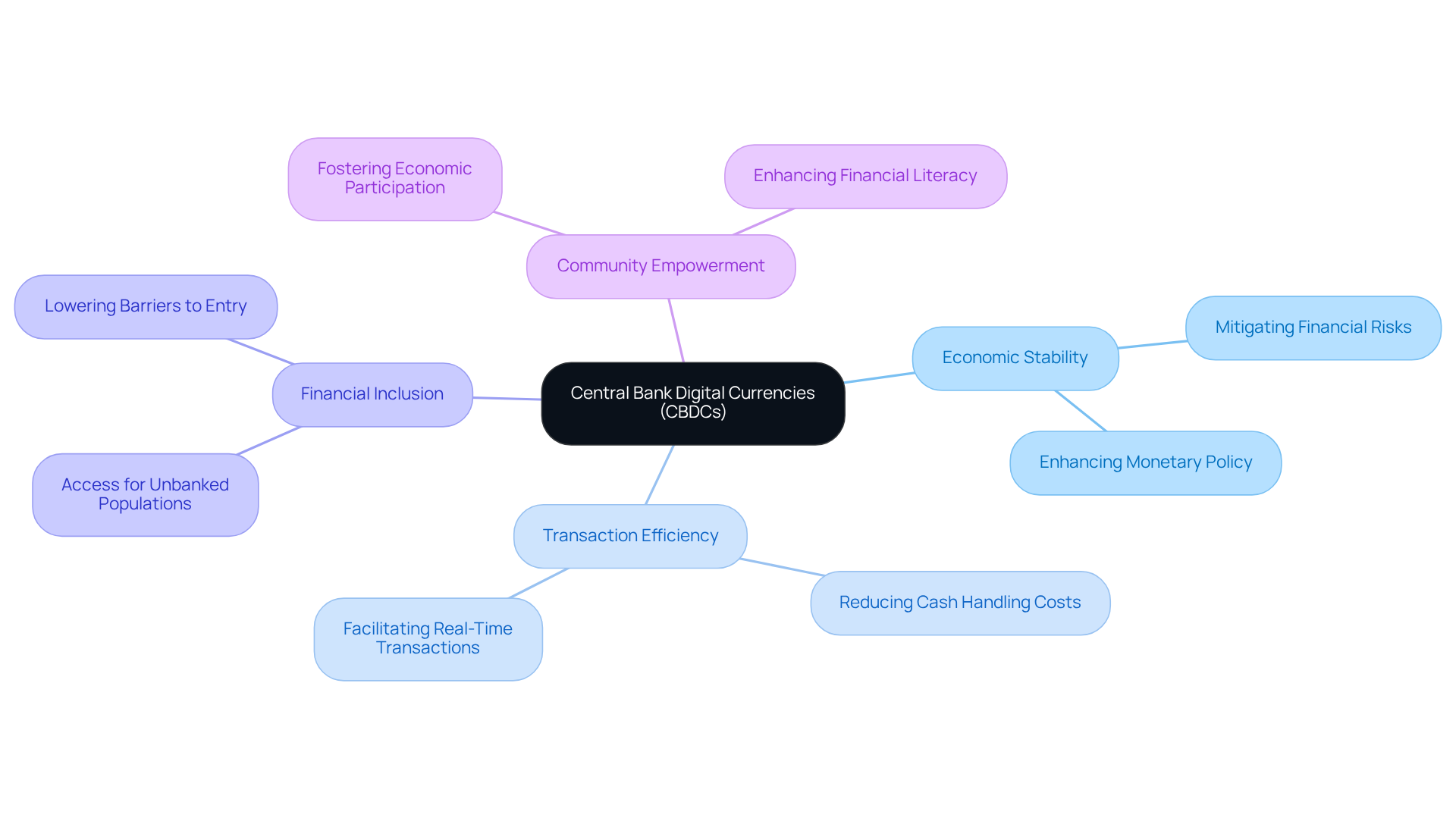

Central Bank Digital Currencies (CBDCs): Redefining Monetary Policy

Central Bank Digital Currencies (CBDCs) present a significant opportunity to address the ongoing challenges of economic stability that many communities face. In a world where managing finances can often feel overwhelming, the digitization of national currencies offers a beacon of hope. By enhancing transaction efficiency and reducing the burdensome costs associated with cash handling, CBDCs aim to alleviate some of the financial pressures that individuals and businesses endure.

Moreover, CBDCs hold the promise of greater financial inclusion. Imagine a world where unbanked populations can finally access the digital financial services they need to thrive. This potential transformation not only empowers individuals but also fosters a sense of belonging within the broader economic landscape.

As more nations explore the implementation of CBDCs, we stand at the brink of a profound shift in the financial sector. This evolution is not just about technology; it’s about nurturing communities and ensuring that everyone has a fair chance to participate in the economy. Together, we can embrace this change and work towards a future where financial stability is within reach for all.

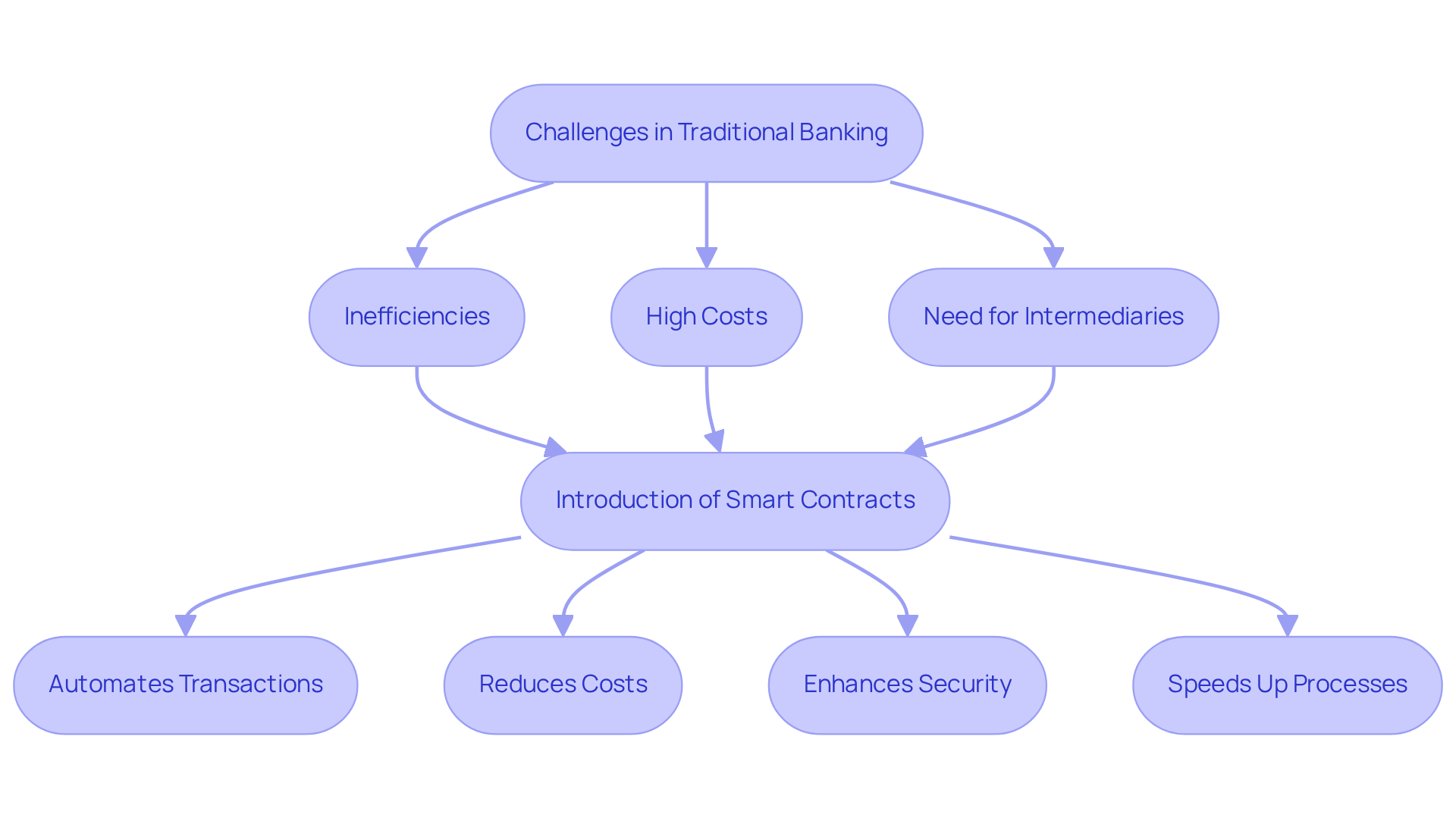

Smart Contracts: Automating Transactions in Crypto Banking

In today's fast-paced world, many of us face challenges with the inefficiencies and costs associated with traditional transaction processes in crypto banks for digital currency management. These hurdles can lead to frustration and missed opportunities, especially for those navigating the complexities of financial services. Smart contracts emerge as a nurturing solution, fundamentally changing how we manage transactions by automating operations and ensuring transparency.

These self-executing agreements, built on blockchain technology, eliminate the need for intermediaries, significantly reducing costs and enhancing efficiency. Imagine the relief of streamlined processes, such as loan disbursement and KYC verification, leading to faster settlements and lower operational overhead. This is not just a technical advancement; it’s a way to alleviate the burdens many face in the financial landscape.

The security provided by smart contracts is paramount. They create tamper-proof records that ensure agreements are executed only when predefined conditions are met. In the dynamic realm of cryptocurrency, where speed and reliability are crucial, this capability is especially beneficial. It offers peace of mind to those who may feel overwhelmed by the rapid changes in the market.

Industry specialists highlight the transformative potential of smart contracts in economic services. Reggie Middleton, CEO of Veritaseum, emphasizes the obsolescence of traditional banking systems and the urgent need for innovative solutions that harness blockchain's capabilities. Similarly, James Smith, CEO of Elliptic, envisions a future where public blockchains facilitate smooth asset ownership transfers, showcasing how effective smart contracts can be in monetary transactions.

Data supports these assertions, revealing that automation in monetary transactions can lead to substantial cost reductions. For instance, integrating smart contracts in cross-border payments can decrease transaction fees and settlement times, making global transactions more accessible and efficient. As the digital currency banking landscape evolves, it is crucial for crypto banks to embrace smart contracts to foster innovation and improve operational efficiency. Together, we can navigate this journey towards a more supportive and efficient financial future.

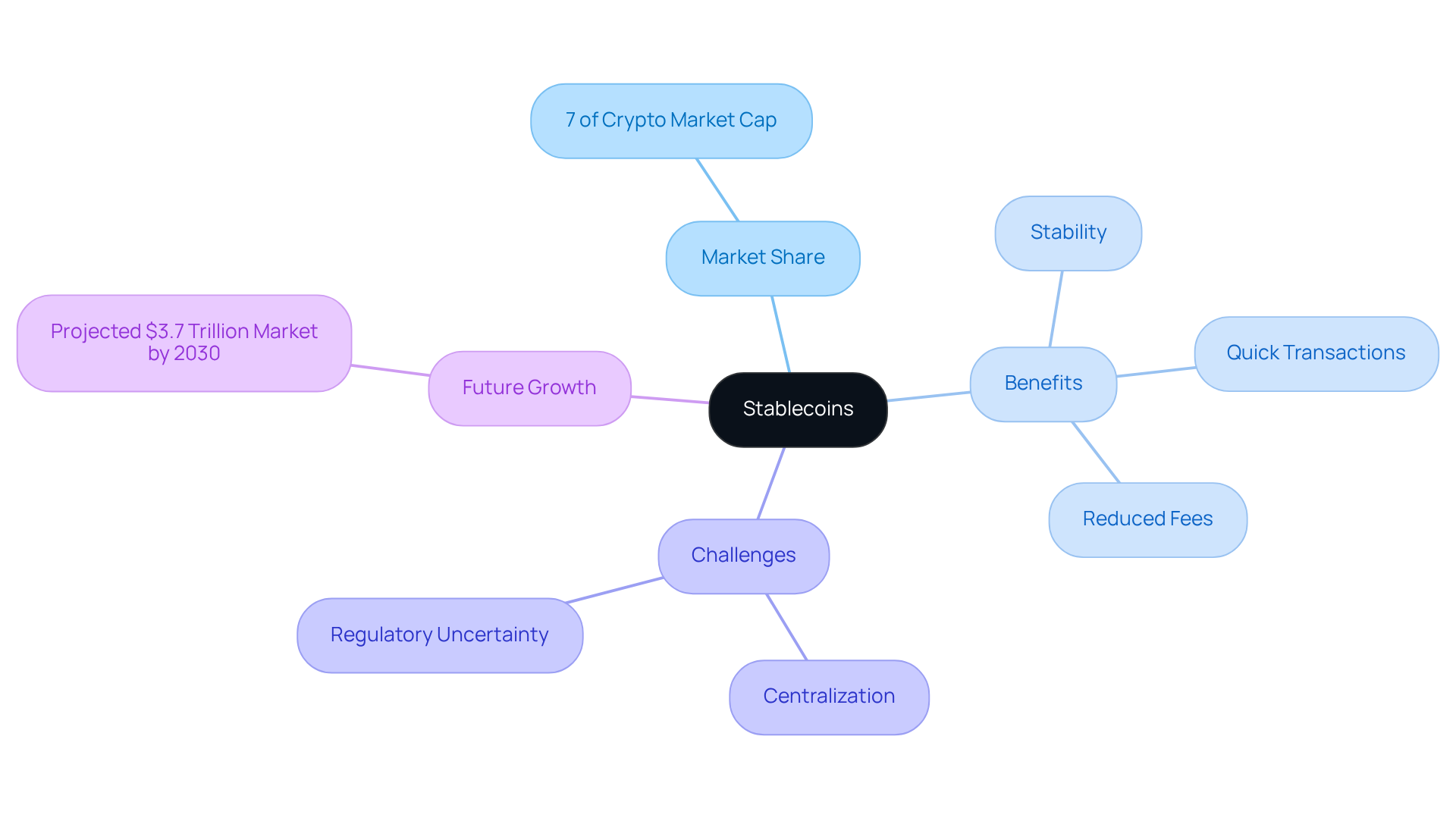

Stablecoins: Bridging Traditional Finance and Cryptocurrencies

Stablecoins serve as a vital connection between traditional finance and cryptocurrencies, offering a sense of stability by maintaining a value pegged to fiat currencies. This stability is especially comforting for investors who may feel anxious about the price swings often seen in other cryptocurrencies. As we look ahead to early 2025, it’s heartening to see that stablecoins account for about 7% of the overall crypto market cap, a sign of their growing acceptance in our economic landscape. By providing the benefits of digital currencies—like quick transactions and reduced fees—while avoiding the price volatility, stablecoins are fostering a wider embrace among users.

However, it’s essential to recognize the challenges that come with this innovation. Economic analysts point out that stablecoins, such as USDT and USDC, have the potential to reshape the global monetary landscape. Forecasts suggest that this market could expand to an impressive $3.7 trillion by the decade's end. This growth highlights how stablecoins are increasingly woven into traditional financial systems, offering a dependable alternative for transactions and investments, which can enhance overall market stability.

Yet, we must also consider the risks tied to stablecoins, including issues of centralization and regulatory uncertainty. These factors could influence their future adoption and integration. As we navigate this evolving landscape together, it’s crucial to stay informed and engaged, ensuring that we can harness the benefits of stablecoins while being mindful of the challenges they present.

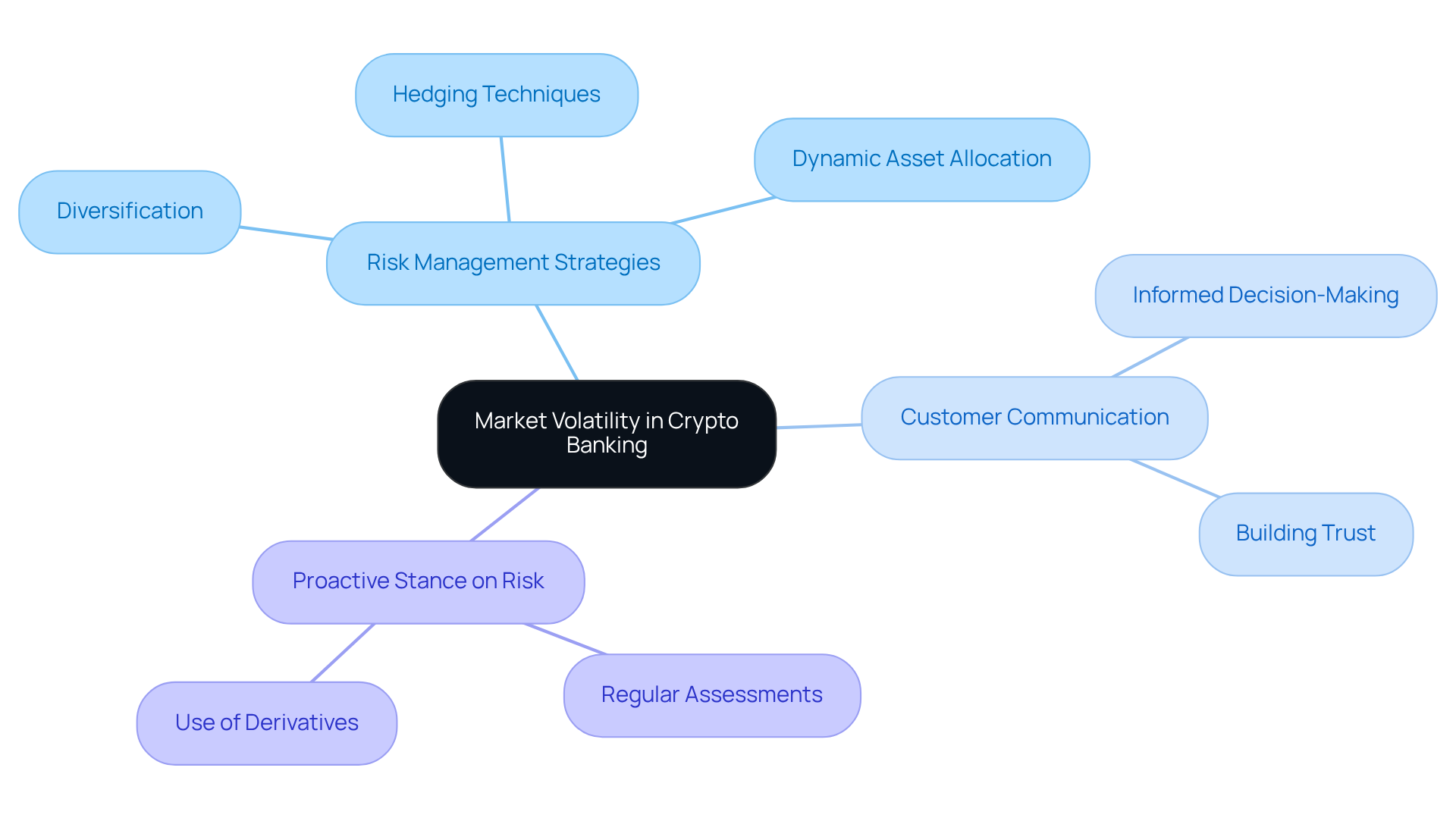

Market Volatility: Navigating Risks in Crypto Banking

Market volatility poses a significant challenge for digital currency institutions, affecting both investors and organizations alike. This uncertainty can be daunting, leaving many feeling vulnerable. To help navigate these risks, banks are embracing comprehensive risk management strategies, including diversification and hedging techniques. For example, numerous institutions are now utilizing dynamic asset allocation, adjusting their portfolios in response to market fluctuations to mitigate potential losses.

Moreover, it is crucial to keep customers informed about the inherent nature of digital currency investments and the associated price volatility. This approach not only fosters informed decision-making but also nurtures trust in the financial relationship. Experts agree that a proactive stance on risk management, encompassing regular assessments and the use of derivatives, is essential for maintaining stability in this rapidly evolving sector.

By implementing these strategies, crypto banks can improve their positioning to withstand market pressures and enhance resilience against future uncertainties. Together, we can face these challenges and emerge stronger, ensuring a more secure financial future for everyone involved.

Future Trends: The Evolution of Crypto in the Banking Sector

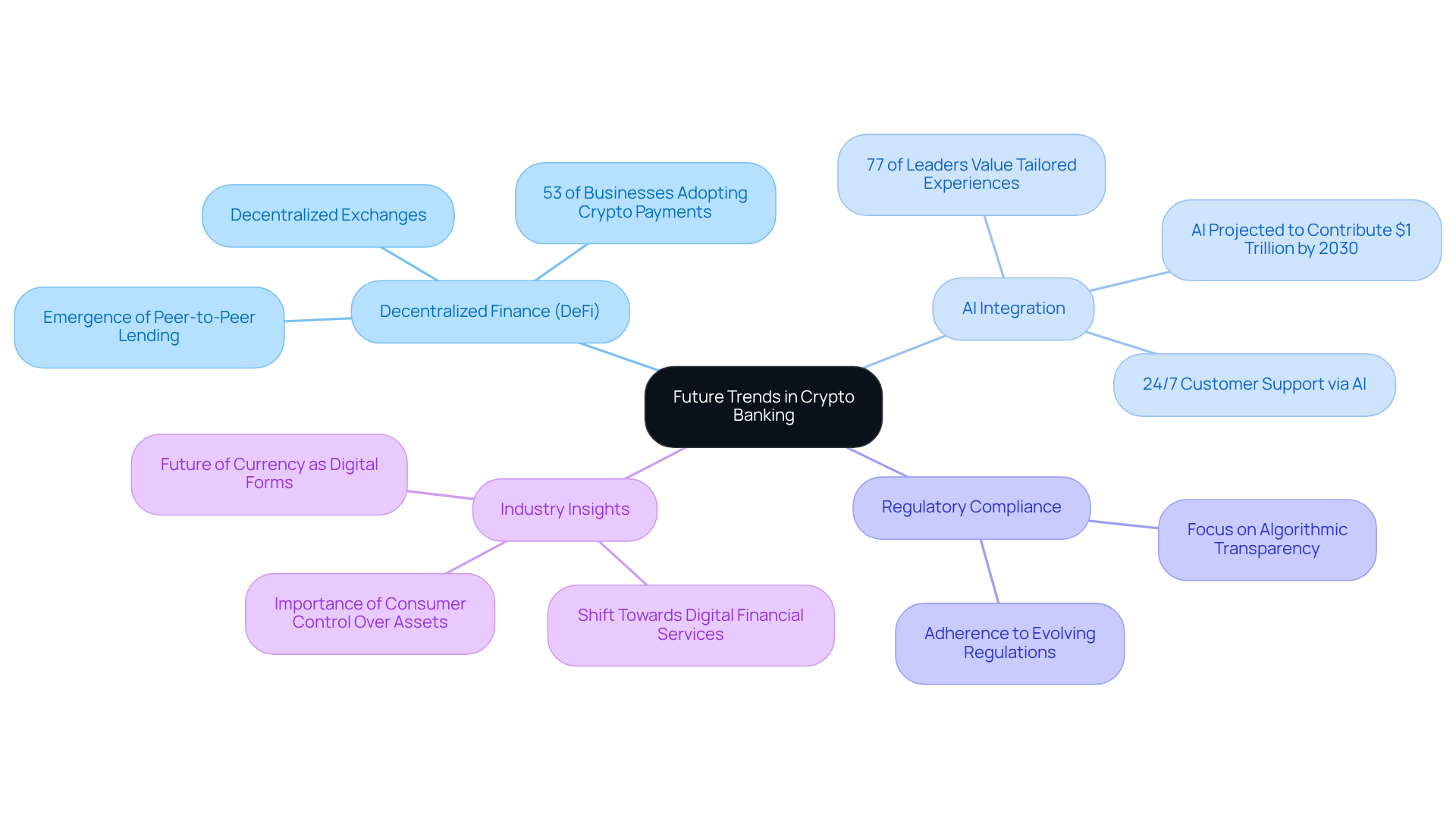

The financial sector is currently facing a significant challenge: the need for transformation driven by technological advancements and shifting consumer preferences. Many individuals and businesses are struggling with traditional banking models that often feel inaccessible and inefficient. However, there is hope on the horizon as crypto banks and decentralized finance (DeFi) solutions emerge, reshaping these outdated systems. By 2025, we anticipate that DeFi will become mainstream, allowing banks to offer innovative products that truly cater to a wider audience. In fact, a remarkable 53% of businesses are either already accepting crypto payments or planning to do so in their online checkouts within the next year, reflecting a growing acceptance of these decentralized solutions.

Simultaneously, the integration of artificial intelligence (AI) is revolutionizing the way we experience financial services. Banks are increasingly leveraging AI technologies to analyze customer data, enabling them to tailor services that enhance user engagement. This shift towards personalization is not just a fleeting trend; it has become a necessity. A staggering 77% of financial leaders believe that providing tailored experiences significantly boosts customer retention. Moreover, AI is projected to contribute an impressive $1 trillion to the global economy by 2030, highlighting its profound impact on the banking sector.

As we navigate these changes, it's essential for financial institutions to focus on regulatory compliance while embracing innovation. Those that prioritize both technological integration and adherence to regulatory frameworks will be better positioned to thrive in this evolving digital landscape.

We can look to successful examples of DeFi solutions in crypto banks, including platforms that facilitate peer-to-peer lending and decentralized exchanges. These innovations not only enhance efficiency but also empower consumers with greater control over their assets, which is a crucial aspect of financial independence.

Industry leaders are increasingly emphasizing the importance of adapting to these changes. Neel Ganu insightfully observes that the future of currency will heavily rely on digital forms, indicating a significant transformation in monetary services. The outlook for crypto banks is indeed promising, with the potential to redefine how we deliver and experience financial services. Together, we can embrace this journey towards a more inclusive and efficient financial future.

Conclusion

The transformation of crypto banks presents a significant challenge in our financial landscape, one that many individuals and communities are grappling with. As technology rapidly advances, the need for banking solutions that genuinely cater to consumer needs has never been more pressing. This shift is not merely about innovation; it’s about enhancing lives and fostering deeper connections between institutions and their clients.

Key developments, such as seamless fiat-to-crypto exchanges, robust security measures, and the integration of smart contracts, are vital in addressing the pain points faced by both banks and their customers. Institutions like Revolut, JPMorgan Chase, FV Bank, and Goldman Sachs are stepping up, each offering unique solutions that prioritize user experience, security, and regulatory compliance. Moreover, the emergence of stablecoins and Central Bank Digital Currencies (CBDCs) marks a hopeful shift towards greater financial inclusion and stability, bridging the gap between traditional finance and the digital currency realm.

As we navigate this evolving crypto banking sector, it’s crucial for all stakeholders to embrace these innovations while remaining aware of the risks involved. The future of finance is not solely about technology; it’s about creating a nurturing system that empowers individuals and communities alike. By staying informed and engaged, we can collectively shape a more secure, accessible, and efficient financial future, ensuring that everyone has a voice in this transformative journey.

Frequently Asked Questions

What challenges do financial institutions face in today's banking environment?

Financial institutions struggle to distinguish themselves in a crowded marketplace while navigating the complexities of digital transformation and connecting with customers meaningfully, often leading to frustration and a sense of isolation.

How does RNO1 help digital financial institutions?

RNO1 empowers digital financial institutions by crafting radical digital experiences using sophisticated UX design principles and performance marketing tactics, helping them build a strong online presence and foster customer loyalty.

What is the mission of RNO1?

RNO1's mission is to enhance digital experiences for crypto banks, enabling them to thrive in the evolving financial landscape and build lasting relationships with their customers.

What services does Revolut Bank offer for fiat-to-crypto exchanges?

Revolut Bank provides a user-centric platform with a highly intuitive interface and real-time exchange rates, allowing customers to transition effortlessly between traditional currencies and cryptocurrencies.

How does Revolut Bank aim to improve the user experience in digital finance?

By simplifying the trading process and making it more accessible, Revolut Bank positions itself as a compassionate ally in transforming how people engage with digital assets.

What role is JPMorgan Chase playing in the integration of cryptocurrency into banking?

JPMorgan Chase is leading the charge by integrating crypto banks within traditional banking frameworks, exemplified by the introduction of JPM Coin for instantaneous transactions between clients.

What is JPM Coin and its significance?

JPM Coin is a digital currency introduced by JPMorgan Chase designed to enable instantaneous transactions, streamlining operations and enhancing efficiency in the financial sector.

What future developments are anticipated with JPMorgan's crypto initiatives?

The launch of JPM Coin in 2025 is expected to significantly impact the financial sector, along with a collaboration with Coinbase allowing Chase clients to connect accounts and redeem rewards for USDC starting in 2026.

How does Jamie Dimon view the potential of stablecoins and blockchain technology?

Jamie Dimon believes that stablecoins and blockchain technology align with customer needs for more effective financial solutions, emphasizing their potential in the evolving financial landscape.