Introduction

Navigating the intricate world of banking advertisements can feel overwhelming for tech startups. As the digital landscape evolves at breakneck speed, it’s easy to feel lost. Many founders share the struggle of trying to effectively engage consumers through targeted, data-driven strategies. This challenge is not just a hurdle; it’s a significant barrier to success in a fiercely competitive market.

With the rise of mobile banking and the integration of AI technologies, the stakes are even higher. Startups often grapple with how to harness these tools to craft advertisements that truly resonate. It’s a common concern: how can you not only keep pace with these rapid changes but also transform them into opportunities? Opportunities for deeper connections with clients and improved conversion rates are within reach, yet they can feel elusive.

But you’re not alone in this journey. Many tech startup founders have faced similar challenges, and there are ways to navigate this landscape with confidence. By embracing a supportive approach and leveraging the right strategies, you can turn these obstacles into stepping stones for growth. Let’s explore how RNO1 can help you not just adapt, but thrive in this dynamic environment.

Understand the Digital Landscape for Banking Advertisements

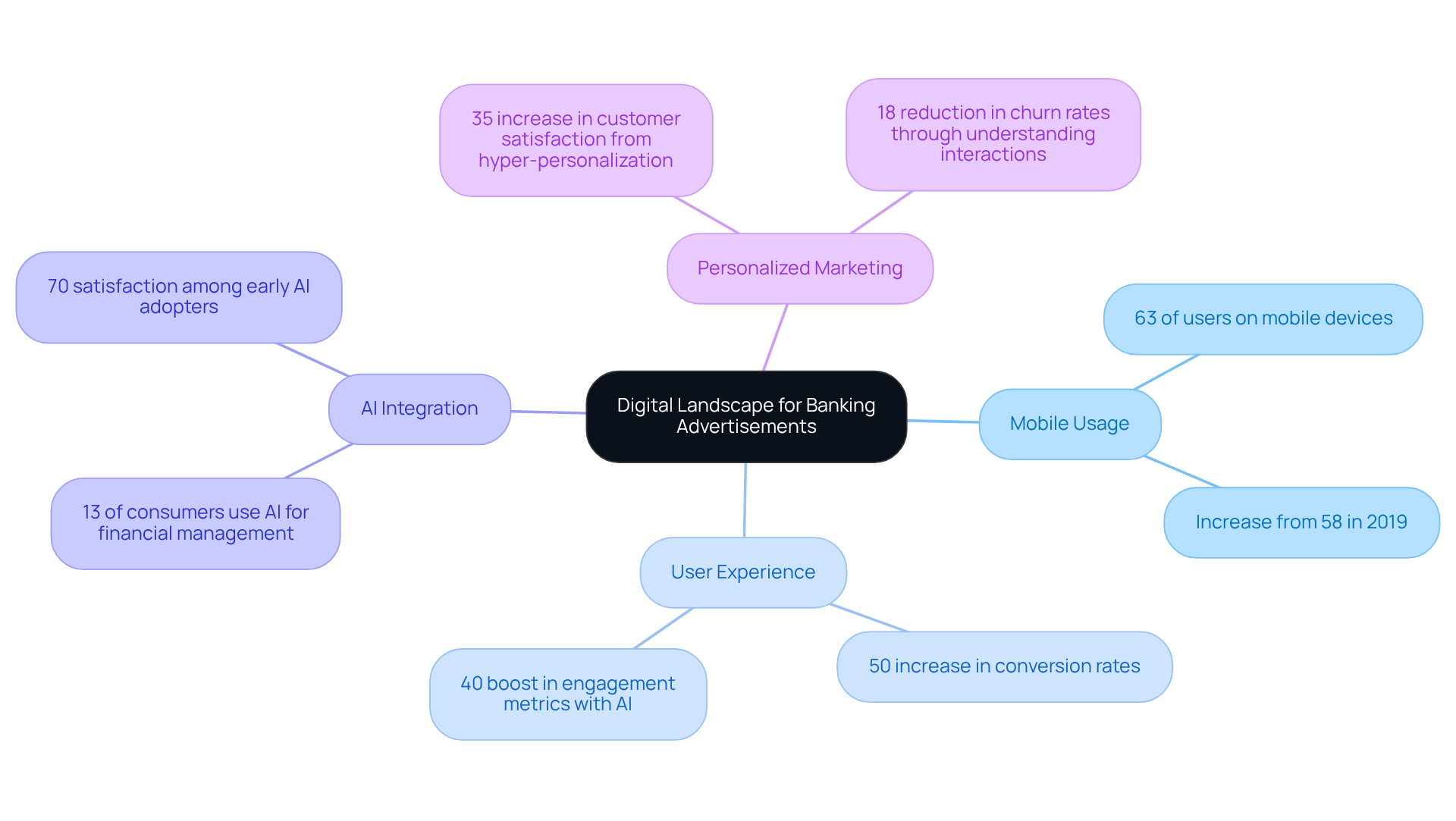

Navigating the financial advertising landscape can feel overwhelming for tech startups. With the rapid evolution of the digital finance sector, it’s crucial to understand the shift towards digital-first strategies. This transition emphasizes the need for personalized client experiences and data-driven marketing. Have you noticed how mobile banking is booming? In late 2024, 63% of bank account holders were using smartphones or tablets for their banking needs, a significant jump from 2019. This trend highlights the importance of optimizing your advertising strategies for mobile platforms.

User experience (UX) is at the heart of how clients perceive and engage with your brand. More and more, banks are turning to digital platforms to deliver targeted bank advertisements and personalized content, enhancing client interactions and satisfaction. Imagine the impact: companies that track client behavior across various touchpoints can see conversion rates soar by up to 50%. Plus, the integration of AI in client interactions is revolutionizing communication, allowing banks to optimize campaigns in real-time and boost engagement metrics by 40%.

By understanding these dynamics, tech startups can craft advertisements that truly resonate with their audience. It’s about connecting authentically, adhering to industry standards, and ultimately driving client acquisition and retention in a competitive market. Remember, you’re not alone in this journey; with the right insights and strategies, you can thrive.

Leverage AI to Enhance Advertising Strategies

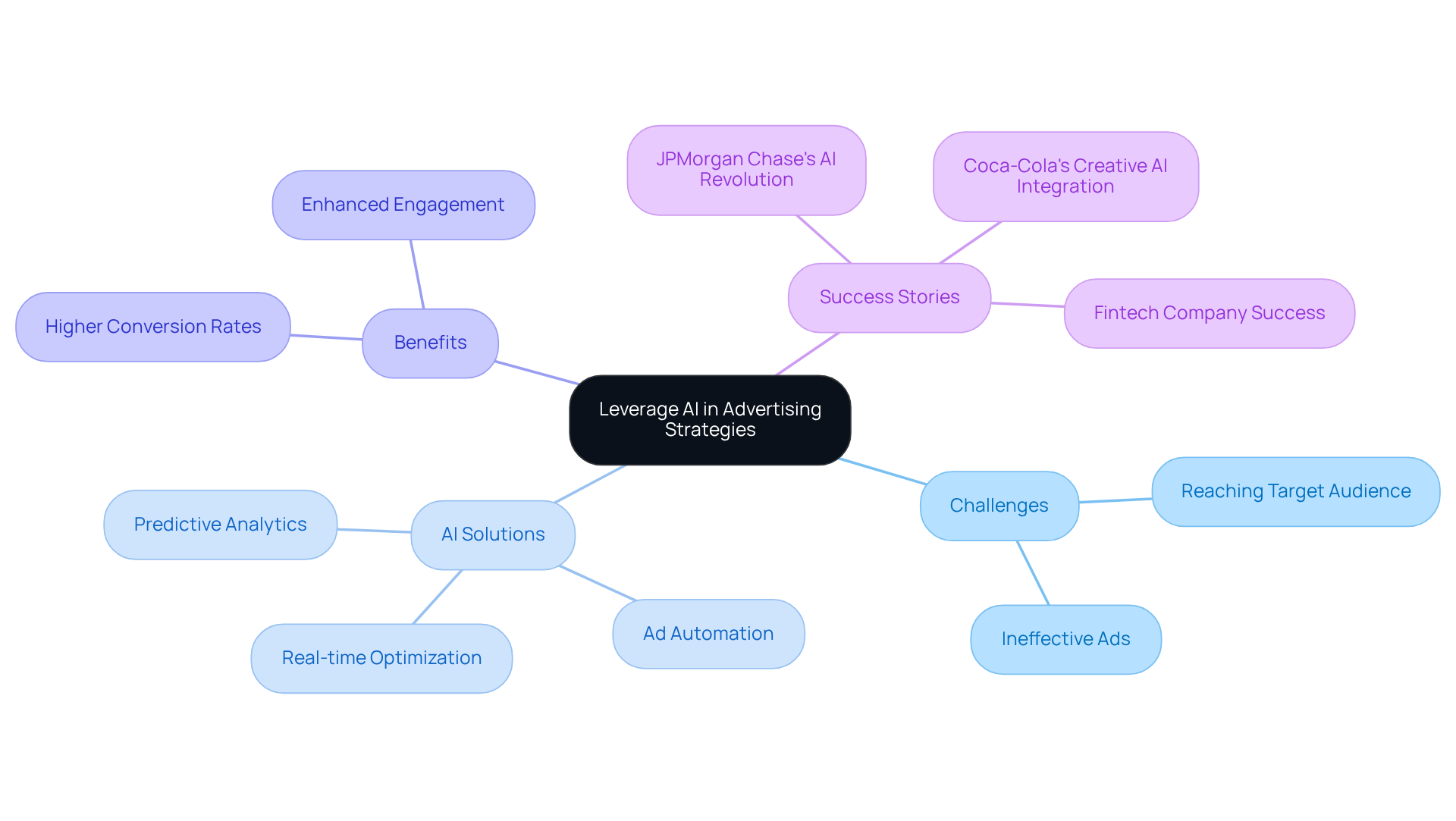

In today’s fast-paced world, many tech startups face the challenge of effectively reaching their target audience using bank advertisements. It’s a common pain point that can lead to frustration and missed opportunities. Imagine pouring resources into ads that just don’t resonate with potential clients. This can feel disheartening, especially when you know there’s a better way to connect with your audience.

But there’s hope. AI technologies are stepping in to revolutionize how technology companies approach their advertising strategies. By harnessing AI-driven analytics, startups can gain valuable insights into client behavior, preferences, and trends, which can also be observed in effective bank advertisements. For instance, predictive analytics can help identify high-intent prospects, allowing for more targeted ad placements that truly speak to the needs of potential customers.

Moreover, AI can automate ad creation and optimization, ensuring that your campaigns are continuously refined based on real-time data. This means you can focus on what you do best while AI handles the heavy lifting. Imagine the relief of knowing your ads are dynamically personalized, significantly enhancing customer engagement and driving higher conversion rates.

Consider the success story of a fintech company that integrated AI into its advertising strategy. Their journey serves as a powerful example of how embracing these technologies can lead to meaningful connections with clients. By implementing AI tools, they transformed their approach, and you can too.

We understand the challenges you face, and we’re here to support you in navigating this landscape. Embracing AI isn’t just about technology; it’s about fostering deeper relationships with your clients and creating a more effective advertising strategy. Let’s explore how we can work together to make this a reality for your startup.

Utilize First-Party Data for Targeted Marketing

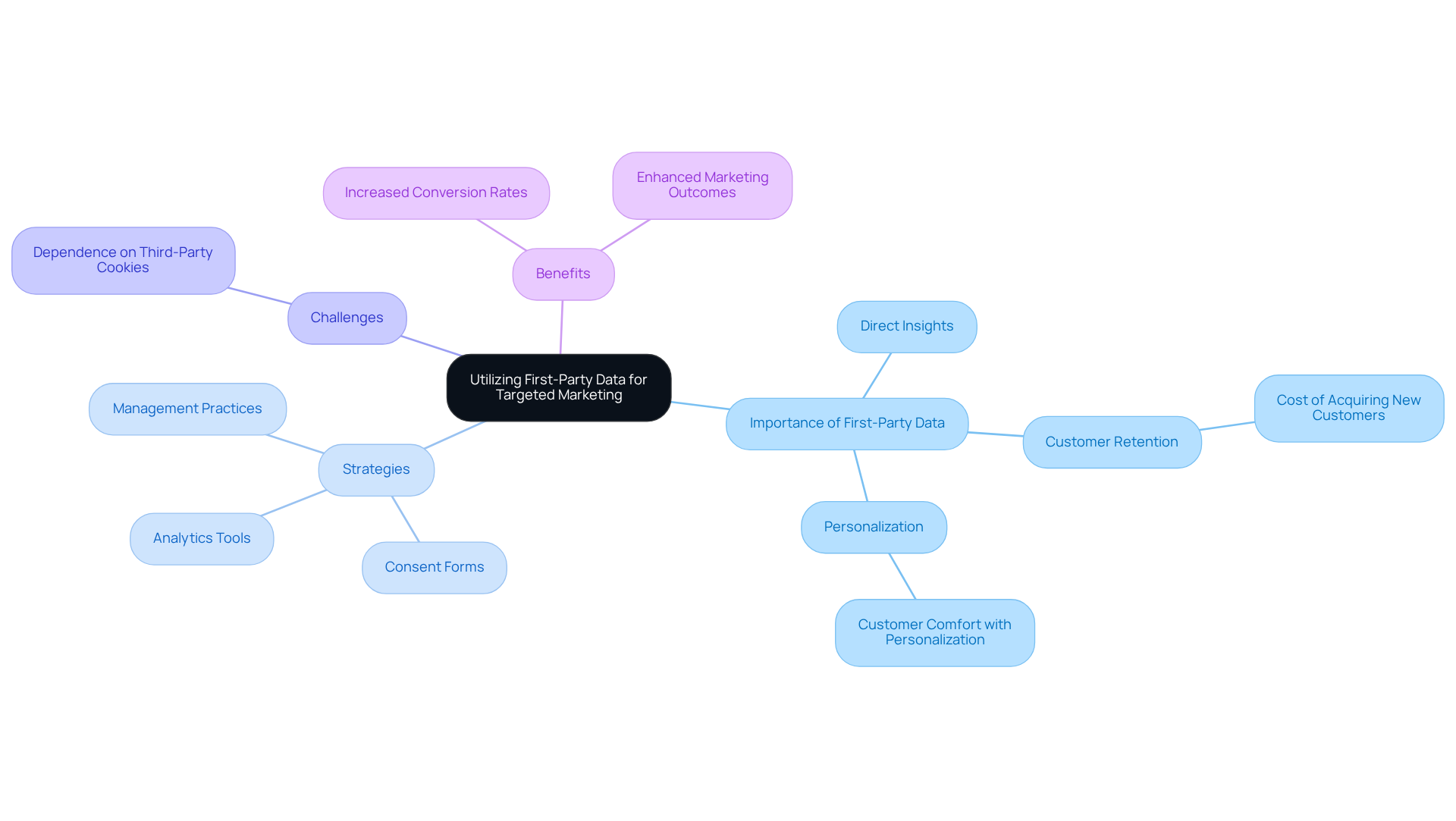

For tech startups like RNO1, first-party information is more than just data; it’s a vital asset that can transform their bank advertisements strategies. Many founders face the challenge of understanding their clients deeply. By directly gathering insights from client interactions on their platforms, RNO1 can uncover what truly matters to their audience - their preferences and behaviors. This understanding is key to effective audience segmentation and crafting personalized marketing campaigns that speak directly to individual needs.

Imagine analyzing user behavior within a banking app. This can lead to tailored advertisements that resonate with specific financial interests, making clients feel seen and valued. In fact, statistics reveal that 73% of business decision-makers who leverage customer behavioral insights expect to see a rise in conversion rates. This highlights the profound impact that targeted marketing can have on a startup's success.

Yet, it’s important to acknowledge the hurdles that many face. An Adobe survey found that as of 2023, 75% of marketers still depend on third-party cookies, which can limit their ability to connect authentically with clients. To truly maximize the effectiveness of their marketing efforts, RNO1 should consider implementing a robust information collection strategy that prioritizes consent-driven approaches. This not only ensures compliance with privacy regulations but also enhances marketing outcomes in a meaningful way.

What might this look like? It could involve:

- Creating clear consent forms that inform users about how their data will be used

- Utilizing analytics tools to monitor user interactions effectively

- Regularly reviewing management practices to ensure compliance

As John Readman wisely notes, "First-party information provides you with trustworthy and direct insights about individuals who have already interacted with your brand." This underscores the importance of first-party insights in nurturing client relationships and building trust.

By focusing on these strategies, RNO1 not only fosters customer trust but also emphasizes the critical nature of data integrity. After all, poor data management can lead to significant pitfalls that no founder wants to face. Together, let’s embrace the power of first-party information to create a more connected and trustworthy experience for clients.

Focus on Future Trends in Bank Advertising

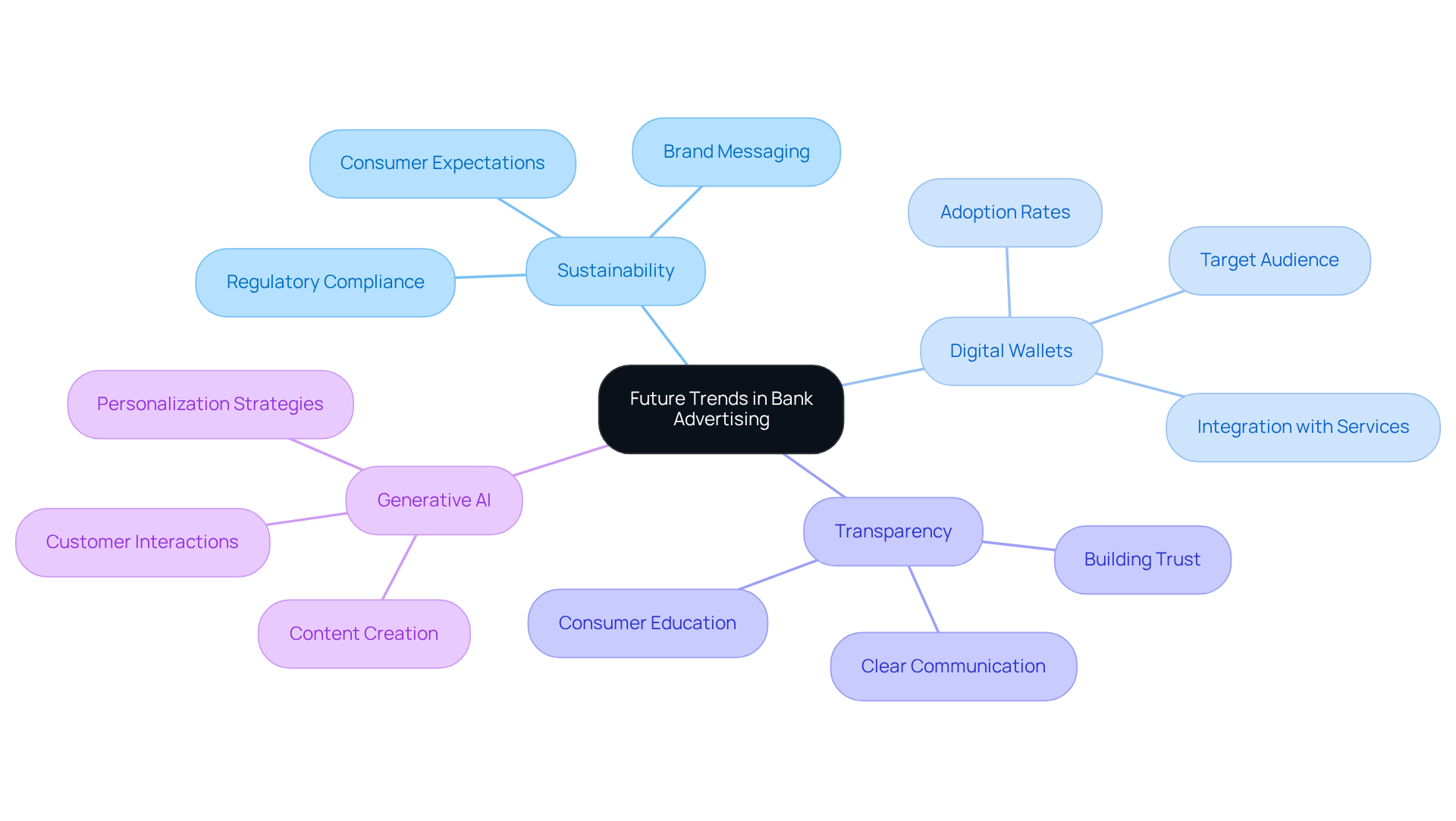

In today’s fast-changing financial landscape, many tech startups find themselves grappling with the challenge of staying ahead of future trends that could shape their advertising strategies. It’s a daunting task, isn’t it? The pressure to keep up can feel overwhelming, especially when you consider the increasing importance of sustainability in banking, the rise of digital wallets, and the growing demand for transparency in financial services. These shifts aren’t just trends; they represent a fundamental change in how consumers engage with financial products.

Moreover, the impact of generative AI on content creation and customer interactions adds another layer of complexity. It’s easy to feel lost in this whirlwind of change, and you might be wondering how to navigate these waters effectively. But you’re not alone in this journey. By anticipating these trends, you can position your advertisements to resonate with consumer expectations and align with industry shifts.

Imagine being able to craft messages that not only speak to your audience’s needs but also reflect the values they care about. This is where RNO1 can step in to support you. We understand the emotional and professional challenges you face, and we’re here to help you remain relevant and competitive in the marketplace. Together, we can turn these challenges into opportunities for growth and connection.

Conclusion

In the fast-changing world of banking advertisements, tech startups face a real challenge: how to adapt and thrive. It’s not just about keeping up; it’s about embracing digital-first strategies, leveraging AI, and using first-party data. These aren’t mere suggestions; they’re essential practices that can truly enhance your advertising effectiveness. By focusing on these elements, you can forge authentic connections with your audience and spark meaningful engagement.

Understanding user behavior and preferences is crucial. It informs your targeted marketing efforts and helps you connect on a deeper level. With AI technologies, you can optimize your campaigns in real-time, ensuring your messages resonate with potential clients. And by harnessing first-party data, you can craft personalized advertisements that truly speak to your audience. In a shifting digital landscape, addressing these challenges is vital for staying relevant in a competitive market.

As the banking sector evolves, it’s essential to stay ahead of future trends. Don’t just anticipate changes; embrace them as opportunities for growth and innovation. By implementing these best practices, you can position your startup as a leader in the financial advertising space, fostering trust and engagement with your clients. The time to act is now-embrace these strategies, and watch your startup flourish in the digital banking world.

Frequently Asked Questions

Why is understanding the digital landscape important for banking advertisements?

Understanding the digital landscape is crucial for banking advertisements because it helps tech startups navigate the rapidly evolving digital finance sector, emphasizing personalized client experiences and data-driven marketing strategies.

What significant trend has been observed in mobile banking usage?

In late 2024, 63% of bank account holders were using smartphones or tablets for their banking needs, which marks a significant increase from 2019, highlighting the importance of optimizing advertising strategies for mobile platforms.

How does user experience (UX) influence client engagement with banks?

User experience (UX) is central to how clients perceive and engage with a brand. A positive UX enhances client interactions and satisfaction, making it essential for banks to focus on delivering targeted advertisements and personalized content.

What impact can tracking client behavior have on conversion rates?

Companies that track client behavior across various touchpoints can see conversion rates soar by up to 50%, demonstrating the effectiveness of data-driven marketing strategies.

How is AI changing client interactions in banking advertisements?

The integration of AI in client interactions is revolutionizing communication by allowing banks to optimize campaigns in real-time, which can boost engagement metrics by 40%.

What should tech startups focus on when crafting advertisements?

Tech startups should focus on creating advertisements that resonate authentically with their audience, adhere to industry standards, and drive client acquisition and retention in a competitive market.