Overview

In today's rapidly changing financial landscape, many individuals and businesses face the challenge of navigating the options between crypto banks and traditional banks. This can feel overwhelming, especially as we witness a significant shift towards digital financial solutions that promise to meet modern consumer needs. Crypto banks, with their ability to provide faster and more cost-effective services, seem like a beacon of hope for those looking to streamline their financial activities. However, it’s essential to recognize the regulatory challenges and risks they encounter—challenges that traditional banks are often better equipped to manage. This juxtaposition highlights not just a shift in services but also the evolving nature of our financial world.

As we explore these differences, it’s important to acknowledge the emotional weight that comes with making such decisions. Many startup founders may feel anxious about the implications of choosing the right banking solution. It’s a journey filled with uncertainty, but you are not alone in this experience. By understanding both sides of the spectrum, we can navigate this landscape together.

Ultimately, the evolution of financial services presents us with an opportunity to embrace the best of both worlds. While crypto banks offer innovative solutions, traditional banks provide stability and regulatory support. By fostering an open dialogue about these options, we can create a supportive community that empowers each other to make informed decisions in this exciting new era of finance.

Introduction

In today's fast-paced world, where financial transactions are often dictated by speed and efficiency, many individuals and businesses find themselves at a crossroads, reevaluating their banking options. The traditional banking system, while established, can feel cumbersome and slow, leaving many frustrated. This is where the emergence of crypto banks comes into play—offering a promising alternative that aligns with the needs of a digital-savvy consumer base. With quicker transactions and lower fees, crypto banks resonate with those seeking a more agile approach to their finances.

Yet, as these new players rise to prominence, significant regulatory challenges loom, raising concerns about their growth and stability. It's essential to consider how this battle between the agility of crypto banks and the established security of traditional banks will shape the future of finance. As we navigate these changes together, it's vital to stay informed and connected, ensuring that our financial choices reflect our values and needs. Together, we can explore these evolving options and find solutions that empower us in this dynamic landscape.

Defining Crypto Banks and Traditional Banks

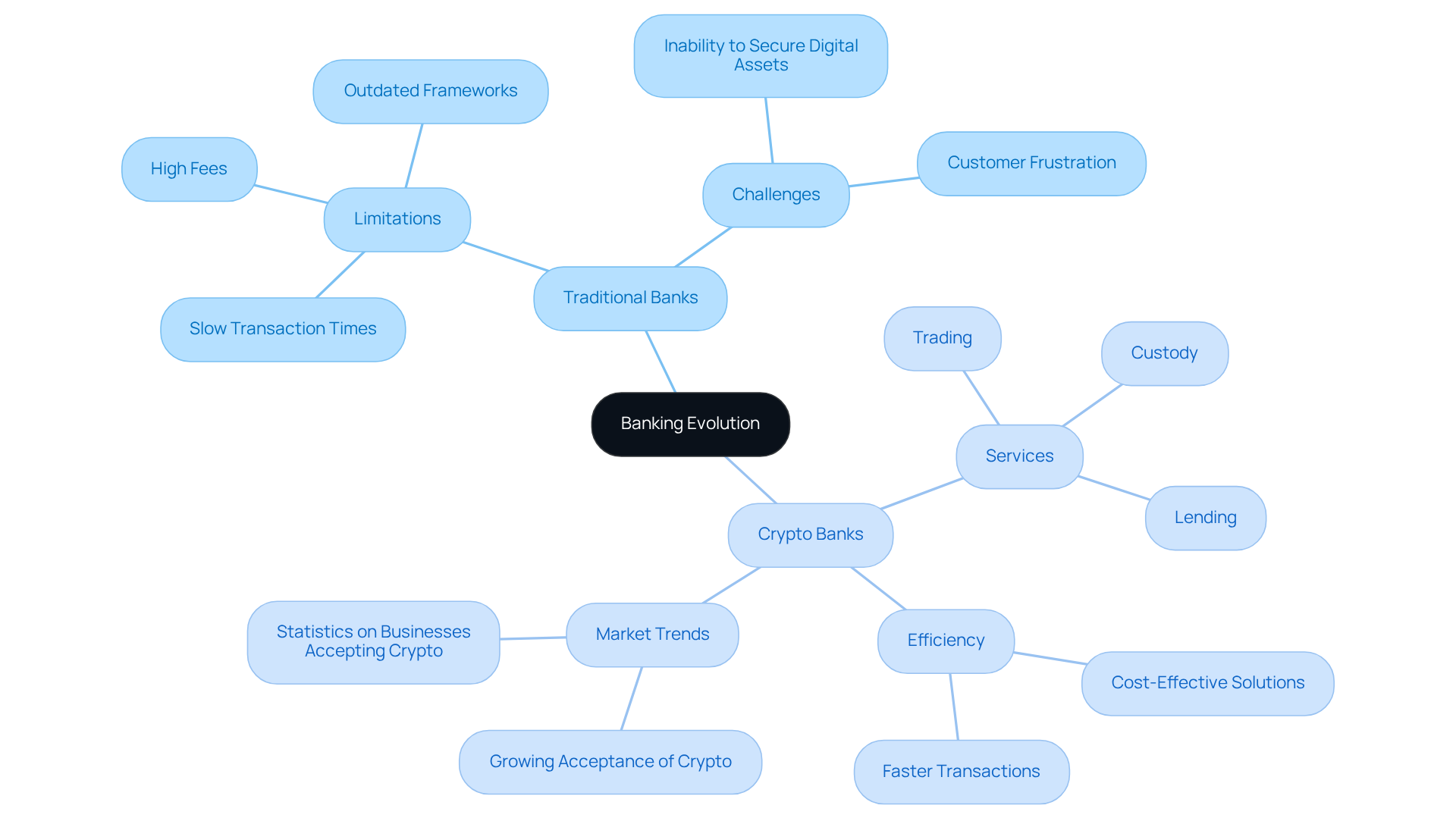

In today's rapidly evolving financial landscape, many individuals and businesses face a common challenge: the limitations of traditional banking systems, prompting interest in banks crypto. These conventional institutions, while offering a range of services, often struggle with slow transaction times and high fees, leaving customers feeling frustrated and underserved. The operational frameworks of these banks can feel outdated, making it difficult for them to meet the needs of a digital-first world.

As we navigate this changing environment, it's essential to recognize the growing role of banks crypto. These specialized financial entities focus on cryptocurrencies and digital assets, providing services like trading, custody, and lending. By harnessing blockchain technology, they enable decentralized transactions that are often quicker and more cost-effective than their traditional counterparts. This shift not only improves efficiency but also aligns with the preferences of consumers who are increasingly seeking online and decentralized monetary solutions.

The rise of digital currency institutions—over 300 operating worldwide as of 2025—highlights the increasing demand for these services. Economic specialists emphasize that these institutions not only enhance operational efficiency but also cater to a generation that values convenience and accessibility. For instance, a staggering 53% of businesses are either accepting crypto payments or planning to do so, underscoring the growing acceptance of cryptocurrencies in everyday transactions.

Matthew Peake, Director of Policy at Onfido, notes that banking institutions are rapidly digitizing to meet their users’ needs for online services. This trend is evident in the fact that more than a quarter of millennials have never set foot in a physical bank, signaling a significant shift in consumer behavior. Yet, conventional institutions face their own challenges, with over 5,000 U.S. establishments currently . This reality further underscores the importance of banks crypto in today’s economic environment, offering a nurturing alternative that can better serve the needs of modern consumers.

As we embrace these changes, it's crucial to foster a sense of community and support among tech startup founders, who are at the forefront of this financial evolution. Together, we can navigate the complexities of this new landscape, finding solutions that empower us all.

Comparing Operational Models and Services

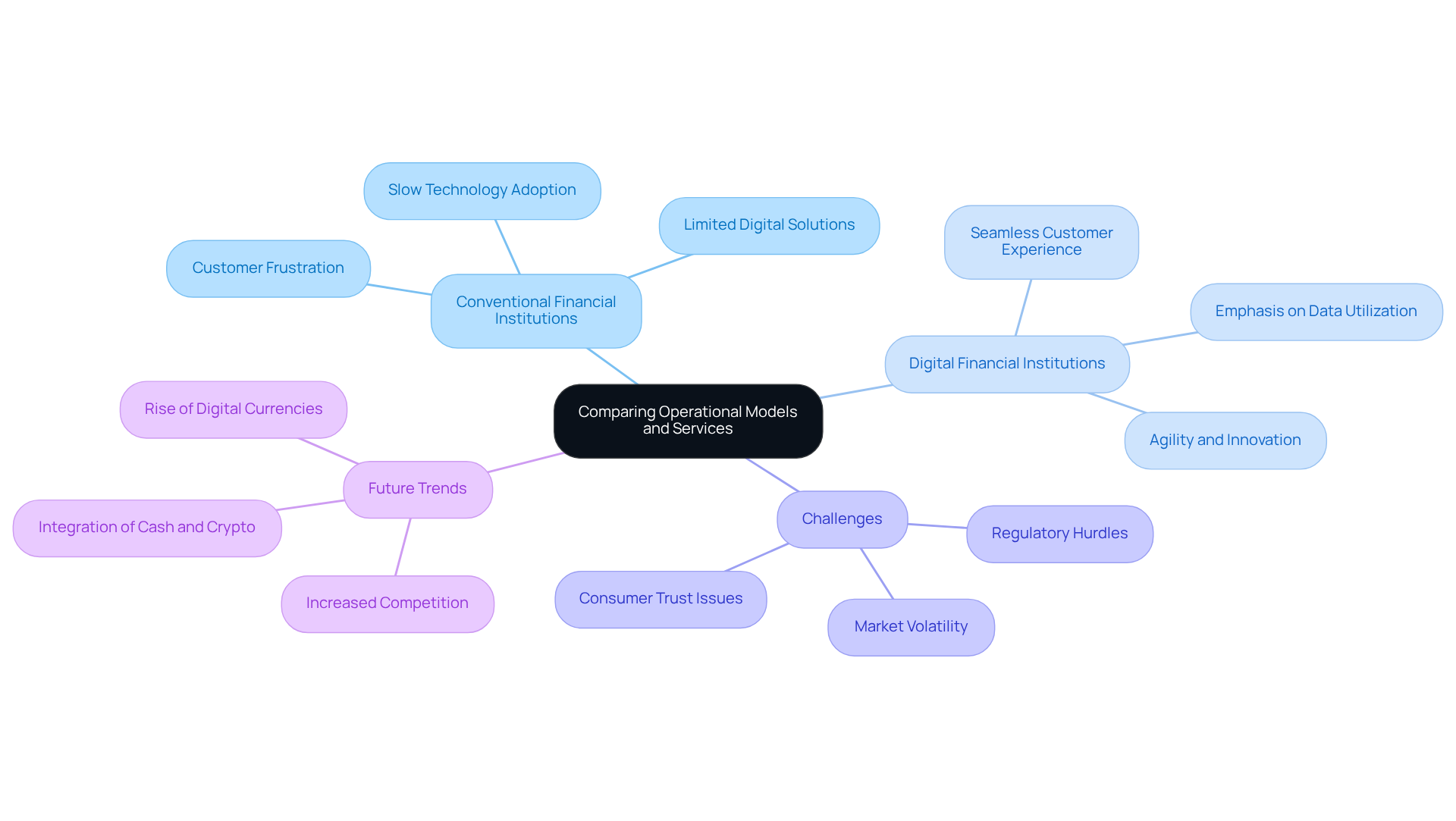

In today's rapidly evolving financial landscape, many individuals and businesses face a common challenge: the need for speed and efficiency in financial services. Conventional financial institutions, while offering a wide array of services like personal loans and investment management, often struggle to keep pace with the digital transformation that is reshaping our world. This can lead to frustration for those who are seeking timely solutions to their financial needs.

The limitations of banks crypto are evident, particularly in their ability to integrate new technologies. Recent statistics reveal that only about 15% of these institutions have fully embraced blockchain technology. This slow adoption restricts their ability to compete with agile digital currency firms that banks crypto and are designed for innovation. As a result, clients who prefer face-to-face interactions may find themselves waiting longer for services that could be streamlined through digital solutions.

The future of finance is increasingly leaning towards banks crypto and other digital financial institutions that understand and prioritize consumer needs. As David M Brear insightfully stated, "Technological innovations will be the heart and blood of the banking industry for many years to come." This sentiment reflects a growing recognition that the capacity to will be essential for success in the financial services sector. Digital institutions are positioned to provide a more seamless customer experience, but they too face their own challenges, including regulatory hurdles and market volatility.

As we navigate this changing landscape together, it’s important to acknowledge both the potential and the obstacles that lie ahead. By fostering a supportive community and sharing experiences, we can empower one another to embrace the future of finance. Let us continue to explore how digital financial institutions can transform our approach to financial services, ensuring they meet the evolving needs of consumers while addressing the complexities of the market.

Evaluating Pros and Cons of Crypto Banks vs. Traditional Banks

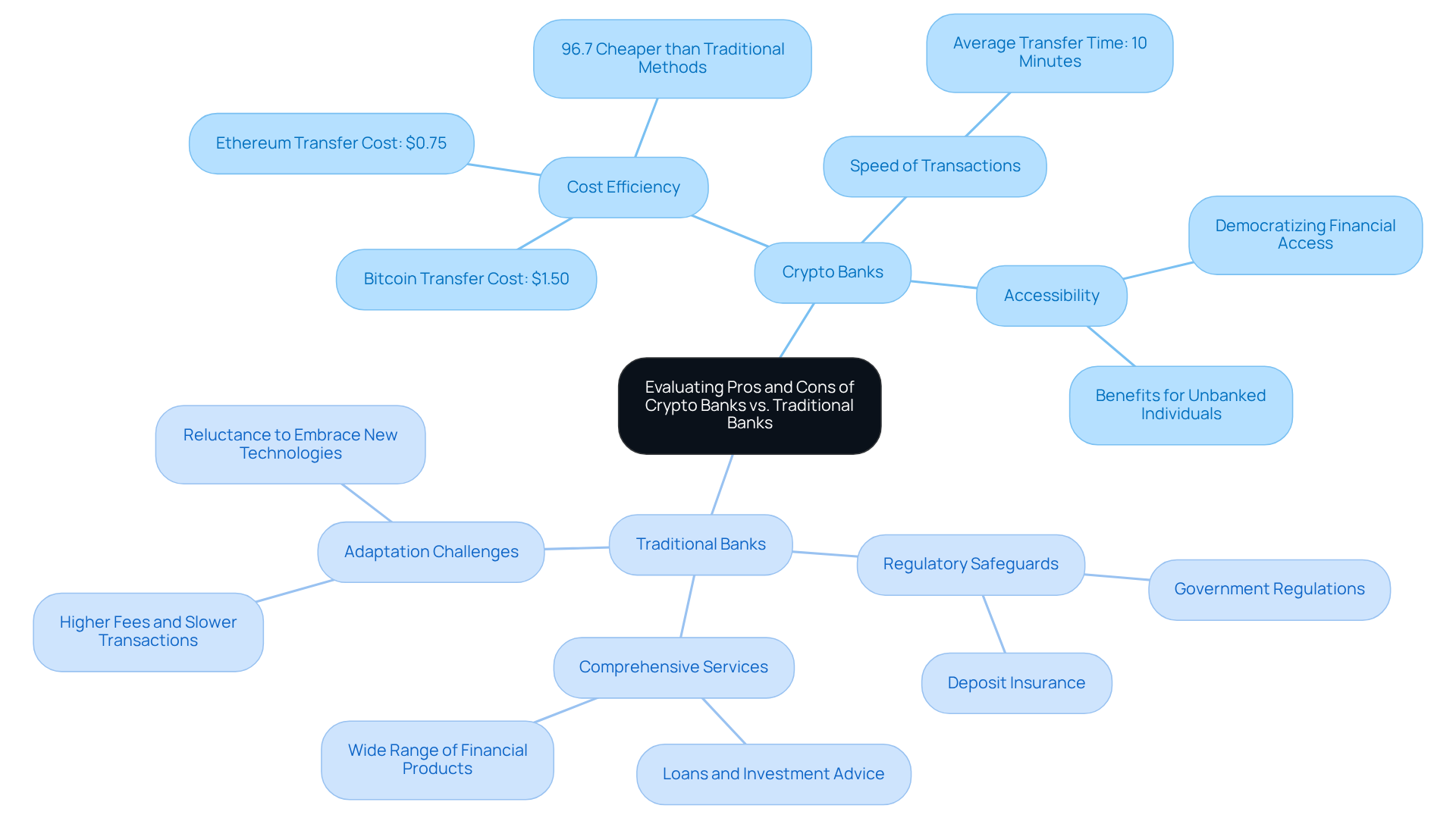

Crypto institutions present a significant opportunity for individuals seeking financial solutions, particularly for those who face barriers in accessing banks' crypto services. The problem is clear: conventional financial entities often impose high transaction costs, with Bitcoin transfers averaging about $1.50 and Ethereum at $0.75. In contrast, traditional systems can charge much more, making it difficult for many to participate in the financial landscape. Moreover, the speed of digital currency transactions is a game changer; they typically occur within 10 minutes, while conventional banking remittances can take 1-10 days due to multiple intermediaries. This speed and cost-effectiveness are especially appealing to unbanked groups, who often struggle to obtain conventional services. Economic analysts highlight the potential of cryptocurrencies to democratize access to financial products, providing investment and savings opportunities to those previously excluded from banks' crypto. In fact, Americans spend over $12 billion annually on remittance fees through traditional financial systems, with an average fee rate of 6.18%. This starkly illustrates the cost advantages that digital banking can provide.

However, it is essential to acknowledge the challenges that banks' crypto financial institutions face. They often lack the regulatory safeguards and stability that traditional institutions provide, which can understandably deter some users. Traditional banks benefit from , offering a sense of security and trust that many consumers value. Additionally, they provide a comprehensive suite of financial services to meet a wide range of customer needs, from loans to investment advice.

On the other hand, conventional financial institutions are grappling with the need to adapt to the digital age. Their higher fees and slower transaction times can hinder their competitiveness, especially as fintech innovations reshape consumer expectations. The reluctance to embrace new technologies may leave them vulnerable to disruption by more agile digital currencies that prioritize user experience and accessibility. John Beccia emphasizes the potential of digital currency to enhance international remittances, showcasing the benefits that digital financial institutions can offer in this evolving economic landscape. By embracing these changes, we can create a more inclusive financial system that serves everyone.

Understanding Regulatory Implications for Both Banking Types

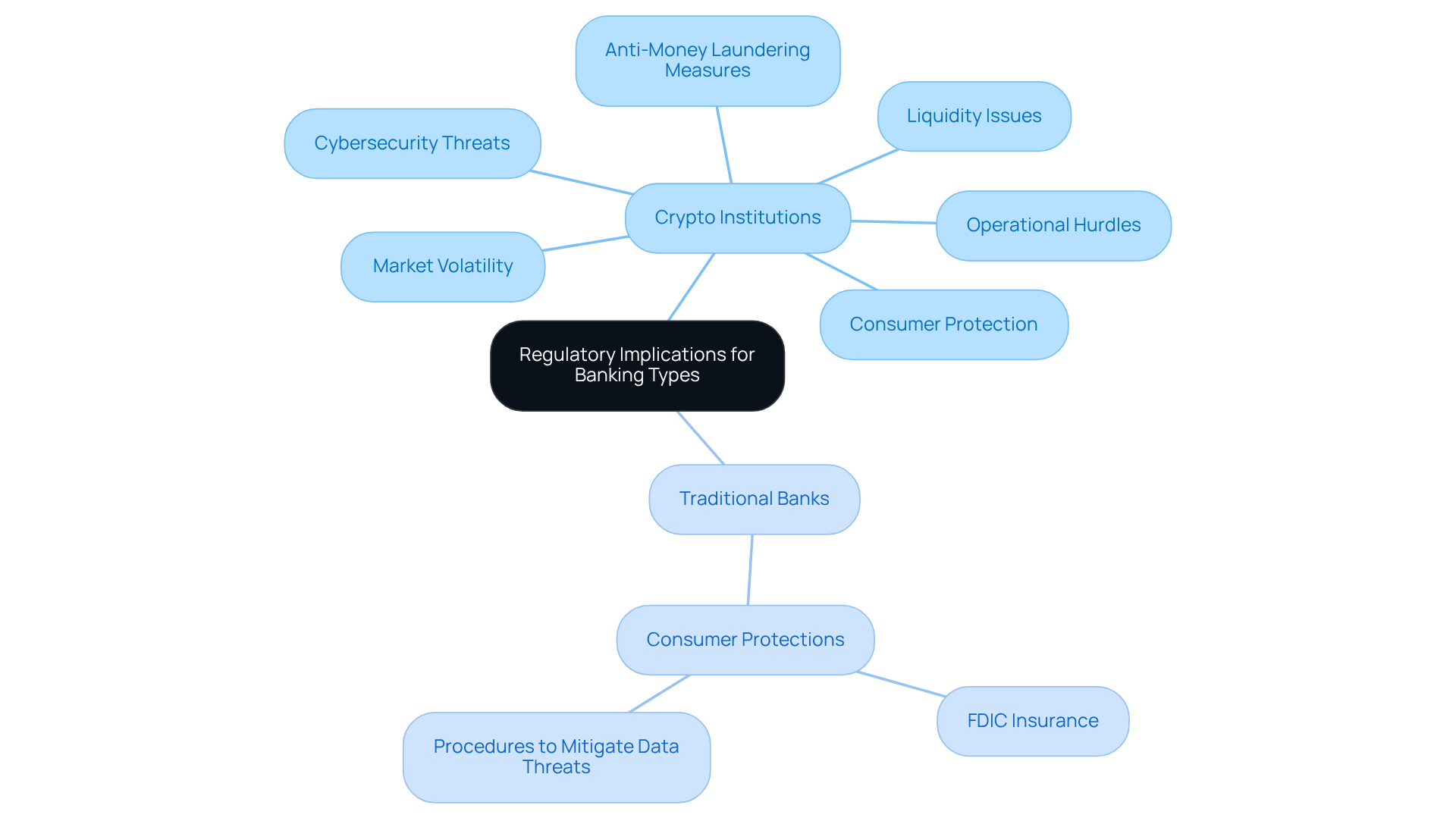

Crypto institutions are currently facing a significant challenge as they navigate a rapidly changing regulatory environment. This uncertainty surrounding compliance and legal frameworks can be daunting, especially with the recent developments like the FDIC's updated guidance on crypto-related activities. This guidance marks a shift towards greater integration of banks crypto within traditional regulatory structures, allowing FDIC-supervised institutions to engage in permissible crypto-related activities without prior approval. However, it also places the responsibility on these institutions to effectively manage associated risks, such as:

- Market volatility

- Liquidity issues

- Operational hurdles

- Cybersecurity threats

- Consumer protection

- Anti-money laundering measures

The lack of comprehensive regulations can expose consumers to potential risks, making robust consumer protection measures more crucial than ever.

In contrast, conventional financial institutions operate within well-established regulatory frameworks that offer significant consumer protections. For instance, FDIC insurance safeguards deposits up to $250,000 per depositor, per account type, providing a sense of security for customers. This regulatory certainty fosters trust and confidence among consumers, yet it may inadvertently limit financial institutions' ability to innovate and adapt to emerging market trends. For example, despite 80% of mobile banking users expressing concerns about the safety of their personal data, traditional financial institutions have implemented procedures to mitigate such threats, enhancing their appeal to customers.

As the financial landscape continues to evolve, both banks crypto and traditional institutions must navigate these regulatory challenges with care to remain competitive and secure. The ongoing discussions among legal professionals about the changing regulatory landscape highlight the importance of compliance in fostering a sustainable banking environment. With 83% of consumers believing that of banking services, there is a pressing need for both types of banking institutions to innovate while prioritizing consumer protection. Together, we can work towards a future where both innovation and consumer safety go hand in hand.

Conclusion

The evolution of the financial landscape presents a challenge for many, as we witness a distinct shift towards banks crypto. These institutions are stepping up to meet the modern consumer's need for speed, efficiency, and accessibility. Unfortunately, traditional banks are often left struggling to adapt to this digital age, which can be frustrating for those seeking reliable financial services. By embracing blockchain technology, banks crypto offer a promising alternative that can alleviate the burdens of high fees and slow transaction times, which many have experienced firsthand.

Throughout this article, we’ve explored the numerous advantages of banks crypto, such as:

- Lower transaction costs

- Faster processing times

- Increased accessibility for unbanked populations

It’s heartening to see the growing acceptance of cryptocurrencies in everyday transactions, marking a significant shift in consumer behavior as more businesses recognize the potential of digital currencies. However, we must also acknowledge the hurdles that both banking types face, particularly regarding regulatory compliance and consumer protection. While traditional banks enjoy the security of established regulations, crypto institutions navigate a complex legal landscape that can feel daunting.

As the financial sector continues to evolve, it becomes increasingly important for us to embrace innovation while ensuring robust consumer protections. It’s essential for both crypto and traditional banks to collaborate and adapt, fostering a future of finance that is not only technologically advanced but also inclusive and secure for everyone. By engaging with these developments and advocating for a balanced regulatory approach, we can work together to create a financial ecosystem that meets the diverse needs of all users, ultimately enhancing the overall banking experience. Together, we can navigate this journey towards a more supportive and accessible financial future.

Frequently Asked Questions

What are crypto banks?

Crypto banks are specialized financial entities that focus on cryptocurrencies and digital assets, providing services such as trading, custody, and lending, often utilizing blockchain technology for decentralized transactions.

How do crypto banks differ from traditional banks?

Traditional banks often face challenges like slow transaction times and high fees, while crypto banks offer quicker and more cost-effective services that align with the preferences of a digital-first consumer base.

What services do crypto banks provide?

Crypto banks provide a range of services including trading, custody of digital assets, and lending, all designed to facilitate transactions involving cryptocurrencies.

Why are more businesses accepting cryptocurrency payments?

The increasing acceptance of cryptocurrencies is driven by the demand for convenience and accessibility, as evidenced by the fact that 53% of businesses are either accepting or planning to accept crypto payments.

What trends are shaping the banking industry?

There is a significant trend of digitization among banking institutions to meet user needs for online services, with many millennials opting for digital banking solutions over traditional physical banks.

How many crypto banks are operating worldwide?

As of 2025, there are over 300 crypto banks operating globally, highlighting the growing demand for these financial services.

What challenges do traditional banks face in the digital asset space?

Over 5,000 U.S. traditional banking establishments are currently unable to secure digital assets, indicating a gap in their ability to meet modern consumer needs.

What is the importance of fostering community among tech startup founders in finance?

Supporting tech startup founders is crucial as they are at the forefront of financial evolution, navigating the complexities of the new landscape and finding solutions that empower consumers.