Overview

The title "7 Crypto Events Shaping the Future of Digital Finance in 2025" highlights a pressing concern in our rapidly evolving world: the significant occurrences in the cryptocurrency landscape that could greatly influence digital finance. As we look ahead, it’s natural to feel a sense of uncertainty about how these events—such as regulatory changes, technological advancements, and emerging market trends—might redefine our financial interactions in the coming years.

These changes can be daunting, stirring feelings of anxiety and apprehension among those of us navigating this complex environment. However, it's important to remember that we are not alone in this journey. By staying informed and engaged, we can embrace these transformations with confidence. Together, we can explore how to adapt to these shifts and find solutions that will empower us in our financial endeavors.

Let’s take this journey together, supporting one another as we navigate the future of digital finance.

Introduction

As the digital finance landscape rapidly evolves, many tech startup founders may feel a sense of uncertainty about the future. The year 2025 stands to be a pivotal moment for cryptocurrency and its myriad stakeholders, filled with both opportunities and challenges. Groundbreaking regulatory changes and innovative branding strategies are on the horizon, alongside the looming impact of IRS enforcement. These developments can be daunting, yet they also present a unique chance for growth and innovation.

This article explores seven significant crypto events poised to shape the future of digital finance, offering insights on how businesses can navigate this complex terrain. Together, we can explore whether these changes will empower startups to thrive or create new hurdles that require strategic adaptation. Your journey in this evolving landscape is important, and understanding these dynamics can pave the way for success.

RNO1: Pioneering Digital Branding Strategies for Crypto Startups

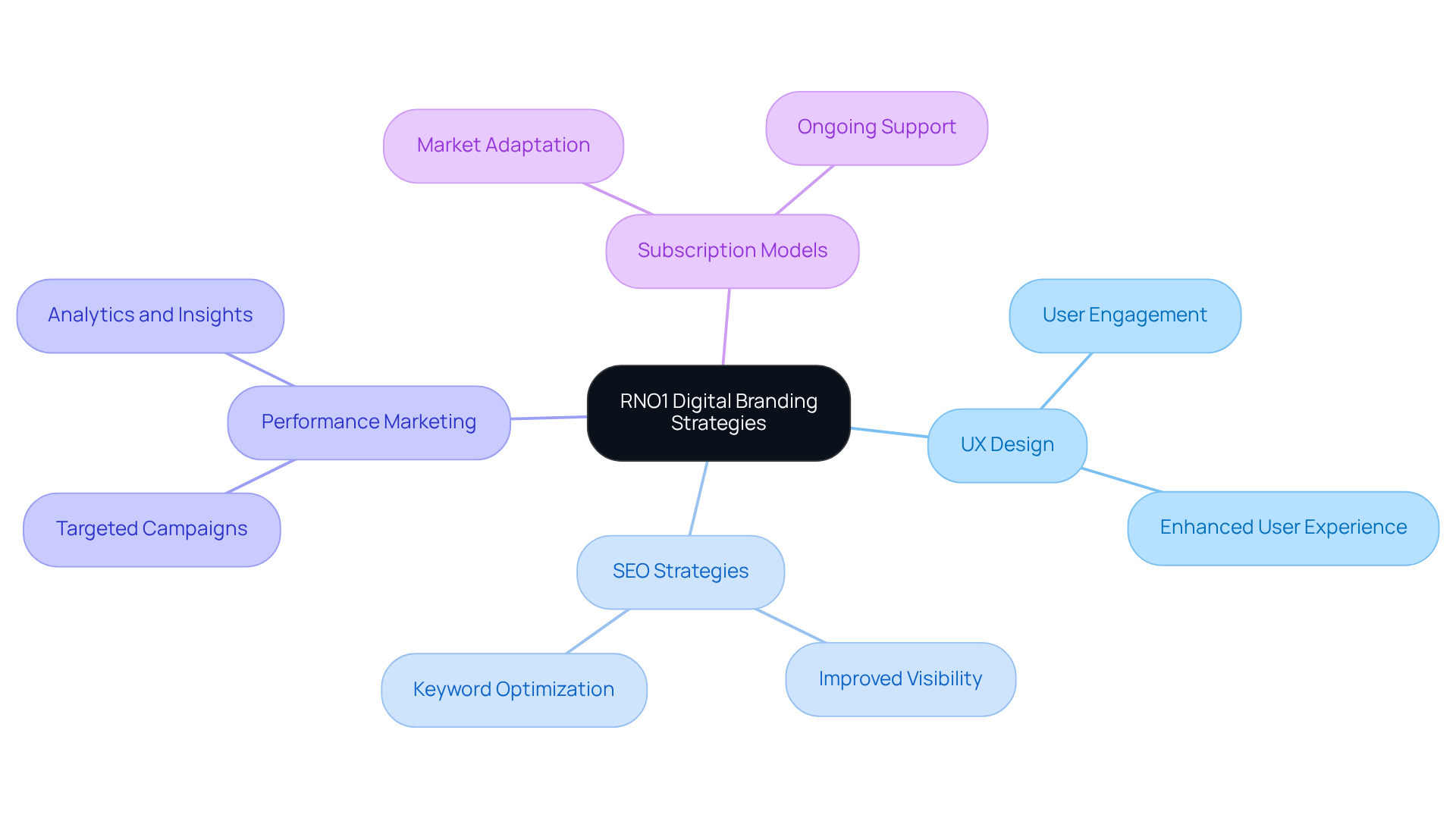

In the fast-evolving world of digital branding, many cryptocurrency ventures face the daunting challenge of standing out. Founders often feel overwhelmed, navigating a competitive landscape where distinctive brand identities can seem elusive. RNO1 understands this struggle and is here to help. By harnessing advanced UX design, SEO strategies, and performance marketing techniques, RNO1 empowers these companies to create unique brands that truly resonate with their audience.

With like Revolve and Ryde, RNO1 provides ongoing support, enabling startups to adapt quickly to market changes and shifting consumer preferences. This proactive approach not only enhances brand visibility but also nurtures lasting relationships with clients, ensuring sustainable growth even amid the fluctuations caused by crypto events in the digital currency market.

As branding specialists often emphasize, effective UX design and strong SEO strategies are essential for improving user engagement and building trust—key factors for success in crypto events within the digital currency sector. RNO1 is dedicated to walking alongside founders, offering the expertise and compassionate support they need to thrive in this dynamic environment.

Senate Cryptocurrency Bill: A Game Changer for Industry Regulations

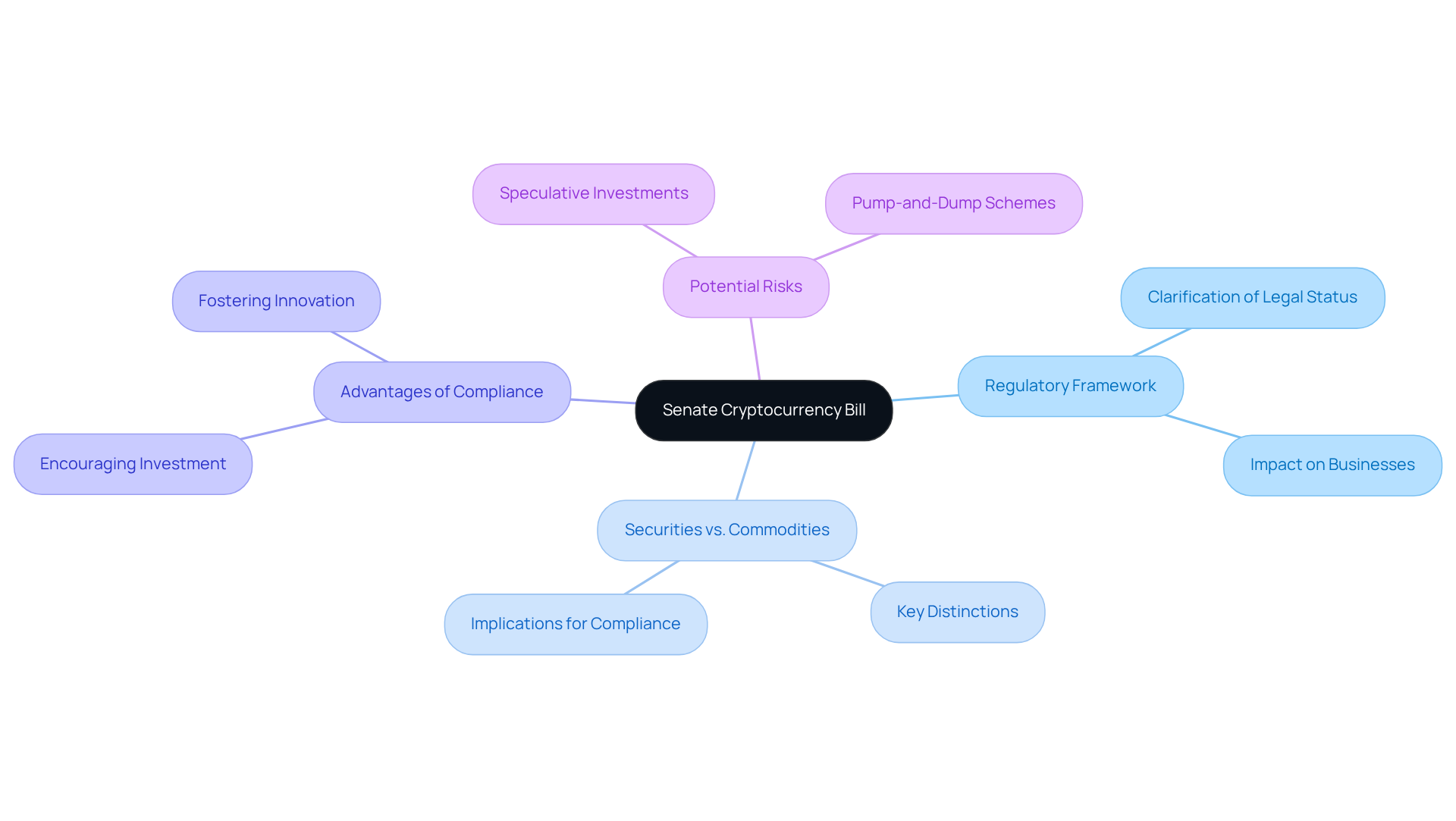

Navigating the recent changes in Senate cryptocurrency legislation can feel overwhelming for many in the digital currency sector. This new regulatory framework aims to clarify the legal status of various digital assets, which is a crucial step for businesses trying to find their way in this complex environment. The challenge lies in understanding the distinction between securities and commodities, a key aspect of the bill that could significantly reduce uncertainty and foster innovation. Companies that take the initiative to adapt their strategies in response to these regulations will likely find themselves at an advantage in this fast-paced market.

Legal experts emphasize that this newfound clarity not only aids compliance but also encourages investment and growth among cryptocurrency ventures. This, in turn, can lead to a more robust digital finance ecosystem. Yet, as we embrace these changes, it’s essential for new ventures to remain aware of potential risks. Speculative investments and pump-and-dump schemes have surfaced as significant concerns, and staying informed about these issues is vital.

As you navigate this evolving landscape, remember that adapting your strategies in line with regulatory changes is key to thriving in this dynamic environment. You’re not alone in this journey; many others are facing similar challenges, and together we can foster a that embraces the opportunities ahead.

White House Report: Advocating for Innovation in Cryptocurrency

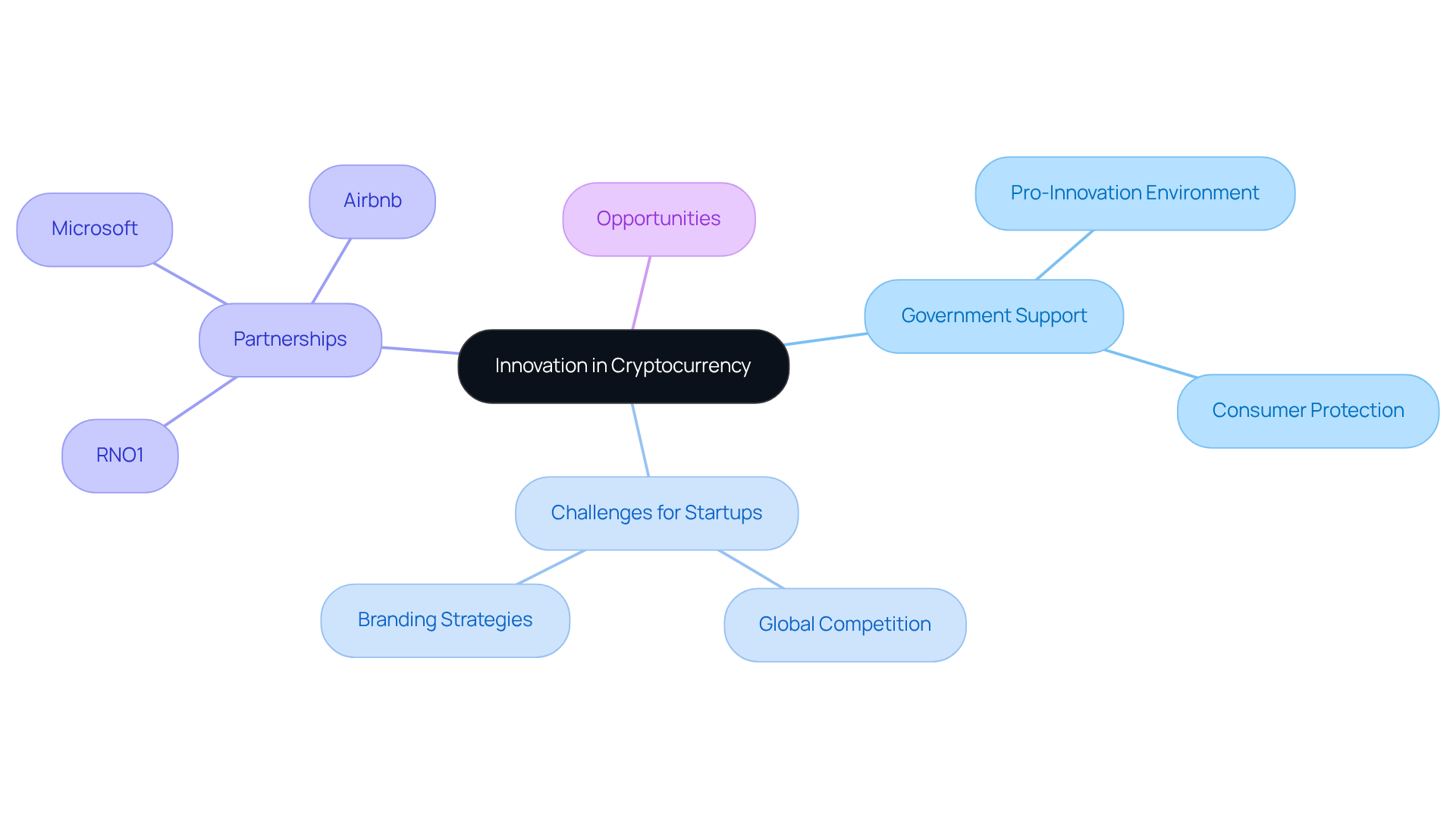

The White House has recently shared a report that advocates for innovation in the cryptocurrency sector, highlighting a crucial challenge faced by many in the tech startup community: the need to foster a pro-innovation environment. This is essential for ensuring that the U.S. remains competitive in the global digital economy. Without such an environment, startups may struggle to thrive, feeling the weight of competition from other nations. The report encourages collaboration between the public and private sectors, aiming to create a supportive framework that nurtures technological advancements while also prioritizing consumer protection.

For crypto companies, this governmental support can be a beacon of hope in their branding strategies, enhancing credibility and attracting investment. Companies like RNO1 serve as a wonderful example of how strategic partnerships can drive digital brand innovation. Their collaborations with industry leaders such as Microsoft and Airbnb not only elevate their market presence but also provide a model for new businesses to follow. By partnering with established brands, digital currency startups can effectively scale their operations and enhance their online experiences, positioning themselves favorably in a competitive landscape.

As you navigate this challenging environment, remember that there are pathways to success. Embracing partnerships and leveraging available support can empower you and your business to flourish. Your journey in the cryptocurrency sector can be filled with opportunities, and by , you can achieve remarkable growth and innovation.

Crypto Tax Rules 2025: Key Changes You Must Prepare For

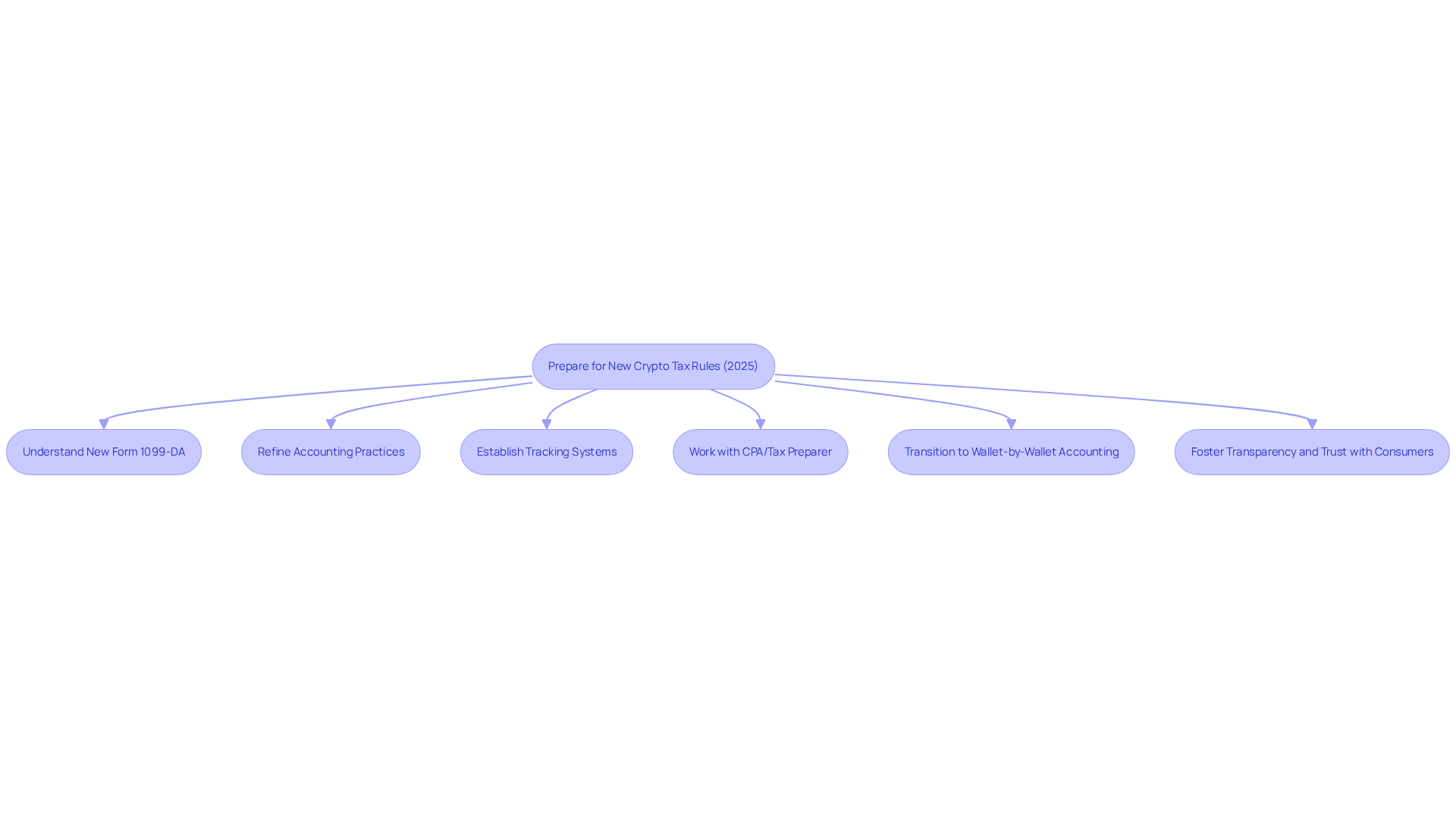

Starting in 2025, businesses will face a significant challenge as the landscape of cryptocurrency taxation transforms. The IRS will now require all cryptocurrency transactions to be reported using the new Form 1099-DA, which will provide comprehensive details on transaction data. This change means companies must refine their accounting practices and establish robust systems to accurately track and report their crypto activities. It’s a daunting task, but it’s essential for ensuring compliance with these new regulations.

This shift not only underscores the importance of transparency but also presents a unique opportunity for businesses to enhance their branding efforts. By carefully complying with these regulations, companies can foster trust with their consumers, which is invaluable in today’s market. As emphasized by the AICPA & CIMA, it is crucial for firms to work closely with their CPA or tax preparer to navigate these changes effectively.

Moreover, transitioning to a wallet-by-wallet accounting method adds another layer of complexity to compliance. Businesses will need to adapt their strategies to reconcile their records with what brokers report to the IRS. While this may seem overwhelming, remember that you are . By reaching out for support and sharing your experiences with others in the industry, you can find the guidance needed to manage these changes successfully. Together, we can embrace this new chapter in cryptocurrency taxation with confidence and clarity.

Taxable Events in Crypto: What Triggers Your Tax Obligations?

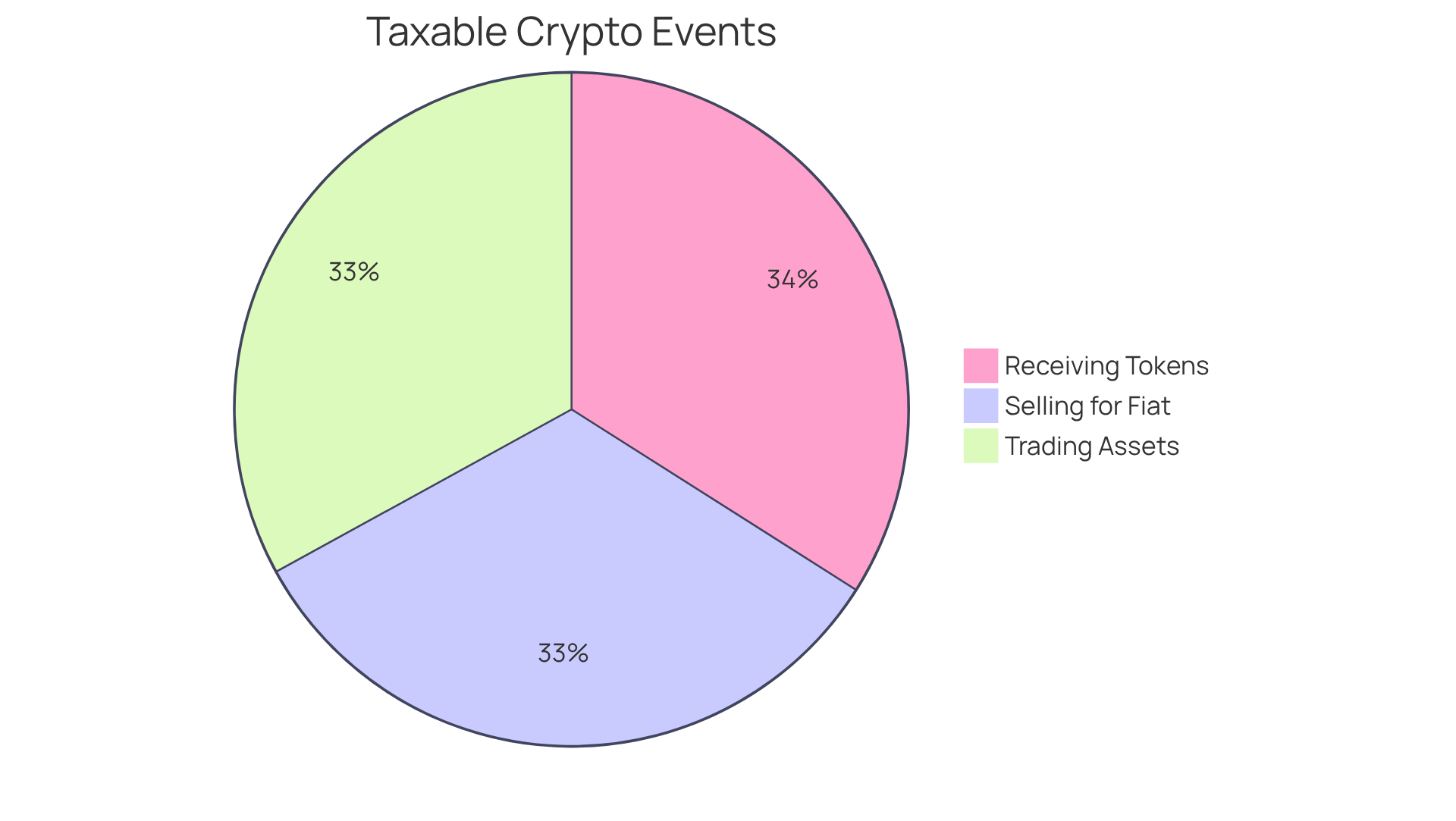

In the ever-evolving landscape of digital currency, many startup founders face a common challenge: understanding the tax obligations that can arise from their activities, often referred to as taxable events. These events can include:

- Selling digital currency for fiat money

- Trading one digital asset for another

- Receiving digital tokens as payment for goods or services

The implications of these actions can weigh heavily, especially when considering additional activities like staking rewards and airdrops, which are also deemed taxable. According to the IRS, cryptocurrency trading is generally considered a taxable event, and it’s essential for taxpayers to report all income related to digital asset transactions, including sales, exchanges, or transfers.

For those venturing into cryptocurrency, educating your team about these triggers is vital. It not only ensures compliance but also helps mitigate unexpected tax liabilities that can cause stress and uncertainty. As tax attorney Sammy Kim wisely notes, "Crypto traders will face scrutiny as exchanges begin mandatory reporting of digital asset transactions to the IRS."

This understanding can foster a culture of awareness that significantly enhances your startup's credibility and operational efficiency. Furthermore, with the introduction of Form 1099-DA for users with gross proceeds exceeding $600, it becomes even more crucial to navigate these obligations with care. By fostering a culture of awareness around these responsibilities, you not only comply with regulations but also build a foundation of transparency and responsibility in your financial dealings. Together, we can with confidence and clarity.

Crypto Staking Rewards: Tax Implications and Best Practices

Navigating the complexities of crypto staking rewards can feel overwhelming for many digital currency startups. The reality is that these rewards are classified as taxable income, assessed based on their fair market value at the time they are received. This requirement from the IRS means that taxpayers must once they gain dominion and control over them. For businesses, this raises the significant challenge of meticulously tracking reward values to guarantee accurate reporting on tax returns.

Imagine the stress of managing these financial obligations while trying to grow your startup. It's crucial to maintain comprehensive records of all staking activities, including dates, amounts, and market values. Consulting with tax experts, such as those at Gordon Law Group, can provide invaluable support in navigating the intricate landscape of digital currency taxation, ensuring that you adhere to IRS regulations.

Regularly reviewing and updating your tax strategies is also essential to align with evolving regulations and market conditions. Utilizing reliable accounting software designed for digital currency transactions can greatly enhance your record-keeping and reporting processes, alleviating some of the burdens you face.

Moreover, it's important to stay informed about ongoing litigation, like the case Jarrett v. United States, as it may influence the taxation of staking rewards. By proactively addressing these tax obligations, you can bolster your credibility and foster trust among your investors and customers. This supportive approach positions your startup for sustainable growth in the competitive digital finance landscape, creating a community that thrives together.

Cryptocurrency's Influence on Banking: What to Expect in 2025

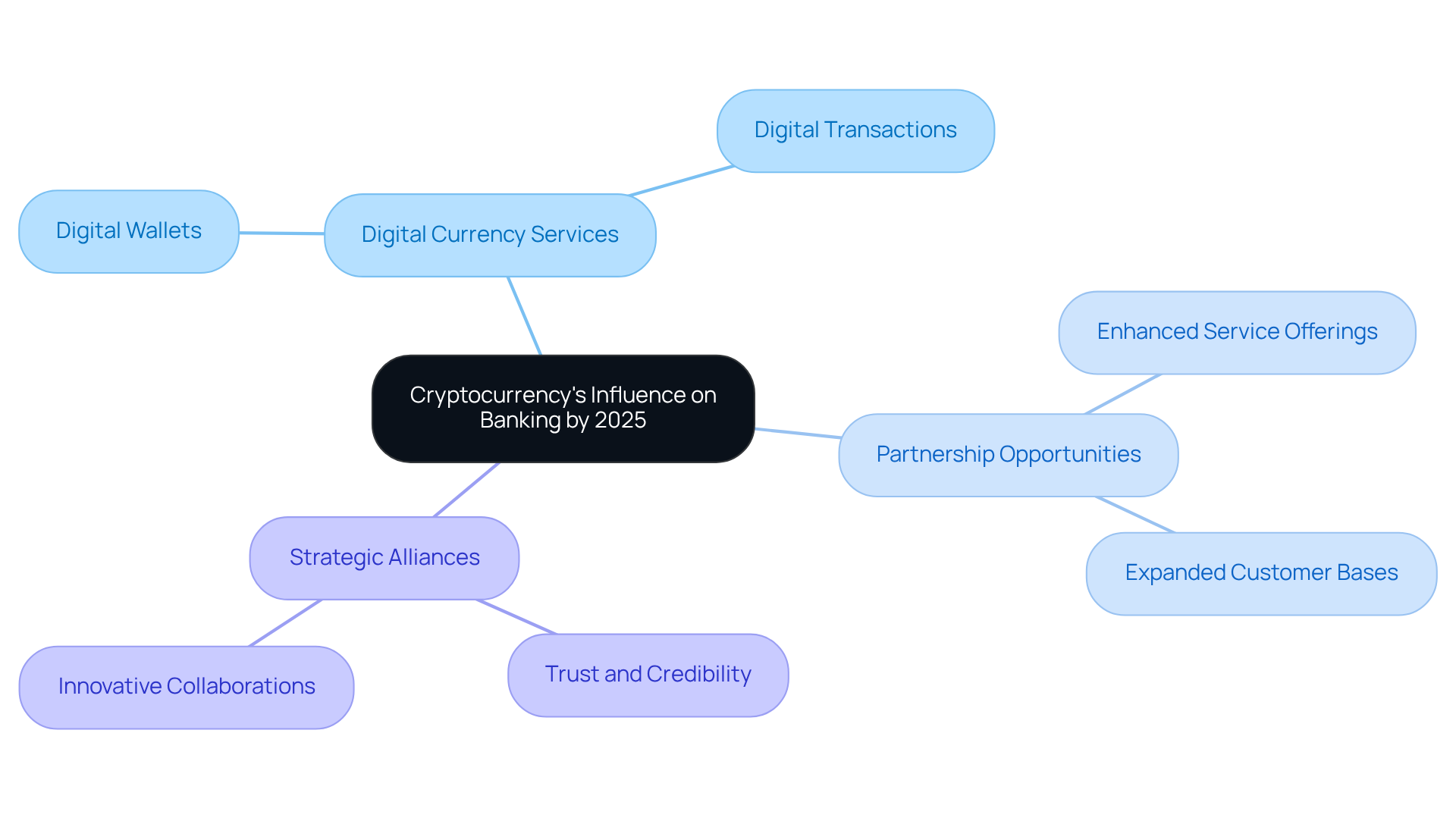

As cryptocurrency continues to gain traction, many founders may feel a sense of uncertainty about its influence on traditional banking systems, particularly as we look toward 2025. The reality is that banks are increasingly exploring ways to incorporate digital currency services, such as offering digital wallets and facilitating digital transactions. This transformation can be daunting, but it also opens doors for digital currency enterprises to forge partnerships with banks.

Such collaborations can enhance service offerings and expand customer bases, which is vital in today’s competitive landscape. By positioning themselves as allies in this evolving environment, crypto firms can harness the trust and credibility of established financial institutions, ultimately strengthening their brand.

RNO1's results-focused approach, encapsulated in 'R is for real results,' underscores the importance of these strategic alliances. They allow emerging businesses to innovate and achieve measurable success through collaborative strategies that enhance digital branding and customer experiences.

Together, we can navigate this changing terrain and for all.

Legal Challenges in Crypto: Navigating Compliance and Risk

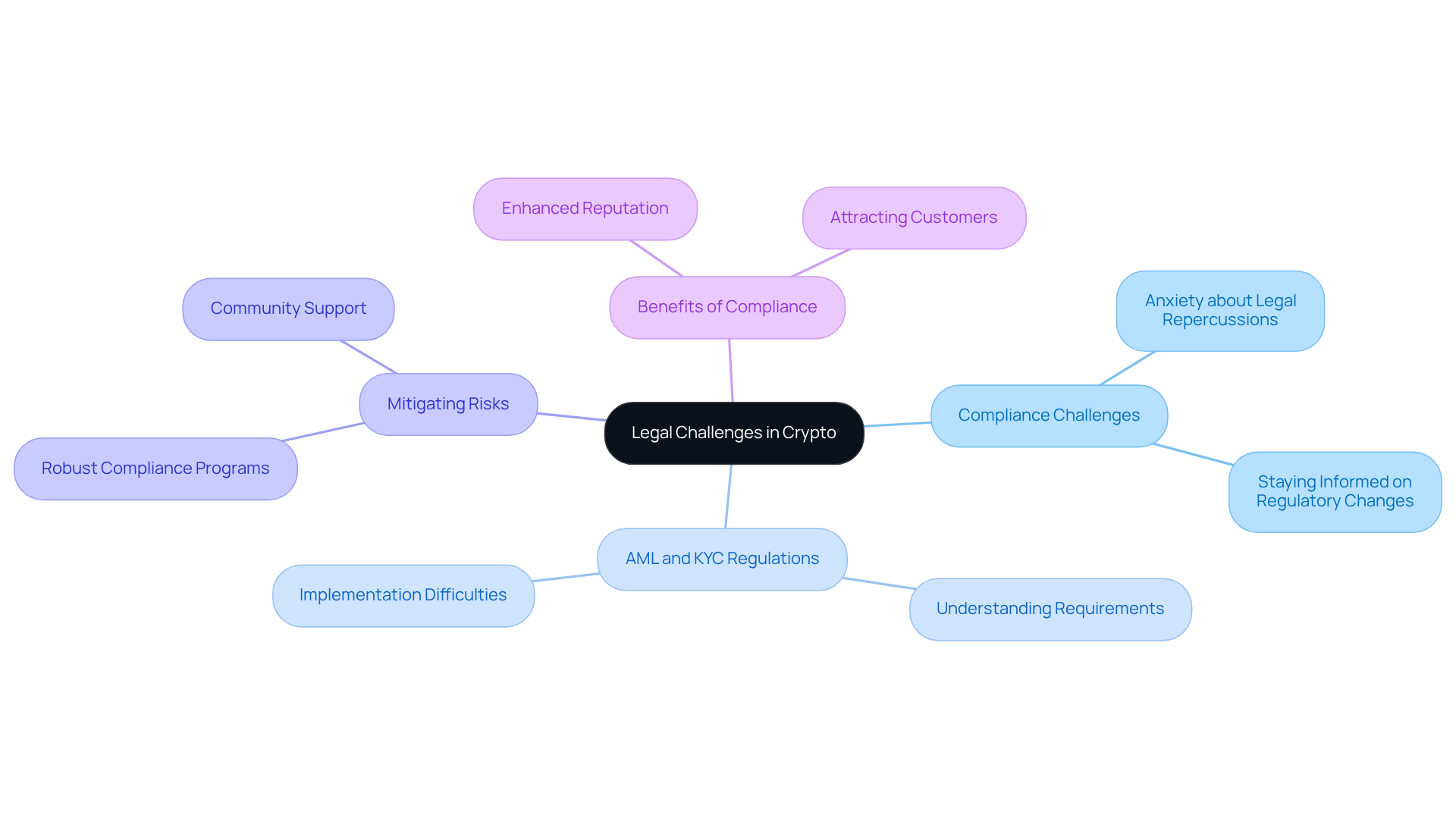

Navigating the legal environment for cryptocurrency can feel overwhelming for many startups, as it is intricate and constantly evolving. This complexity poses significant challenges, particularly when it comes to compliance with regulations like anti-money laundering (AML) and know your customer (KYC) requirements. The pressure to adhere to these regulations can lead to anxiety about potential legal repercussions. However, it is crucial for crypto startups to stay informed about crypto events that pertain to these regulatory changes. By implementing robust compliance programs, they can effectively mitigate risks and foster a sense of security.

When startups demonstrate a commitment to legal compliance, they not only protect themselves but also enhance their reputation in the marketplace. This proactive approach can attract more customers who value transparency and integrity. Remember, you are not alone in this journey; many founders share your concerns. Together, we can navigate these challenges and build a community that prioritizes compliance and trust in the cryptocurrency space.

Emerging Crypto Projects: Key Funding Events to Watch

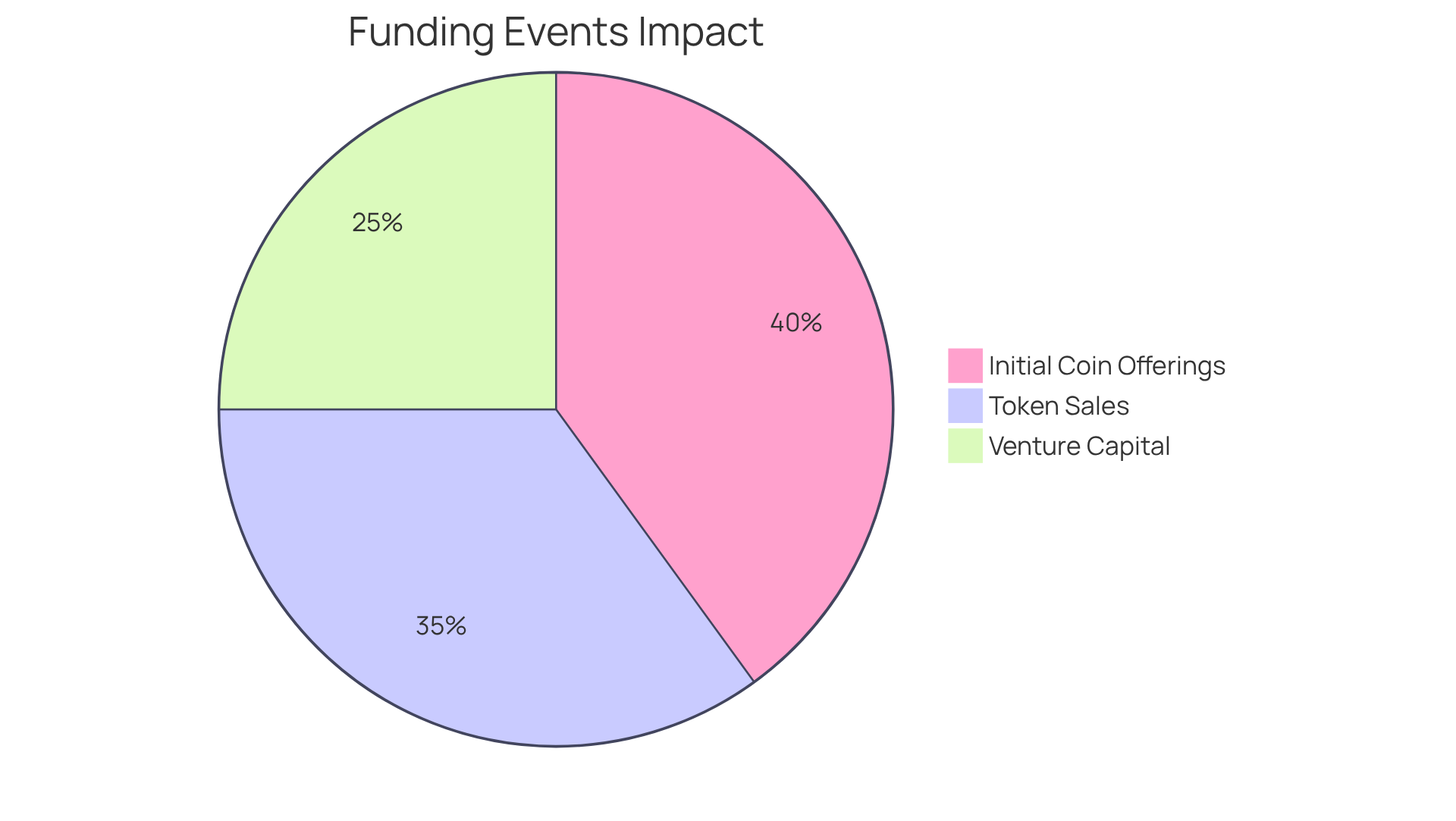

In 2025, many tech startup founders may find themselves facing the daunting challenge of securing funding for their emerging digital currency projects. This can be a stressful experience, as the landscape is filled with uncertainties. Key funding events, such as:

- Initial coin offerings (ICOs)

- Token sales

- Venture capital investments

are anticipated to be crucial crypto events that will shape the future of these projects. The pressure to participate in these crypto events can feel overwhelming, yet it's essential for startups to engage actively in them to secure the necessary funding and enhance their visibility in the market.

By aligning their branding strategies with these funding opportunities, crypto enterprises can not only attract investors but also foster a strong community around their projects. Imagine the sense of relief and excitement when your brand resonates with potential investors and supporters. It's important to remember that you are not alone in this journey; many founders share similar experiences and emotions. Together, we can and find the right path forward.

As you consider your approach, think about how you can create a narrative that speaks to your audience. Sharing personal stories or testimonials can evoke empathy and connect with others who are on a similar journey. By fostering an inclusive environment, you can encourage interaction and build relationships that will support your growth. Remember, the road to success may be challenging, but with the right strategies and a caring community, you can thrive in the evolving world of digital currency.

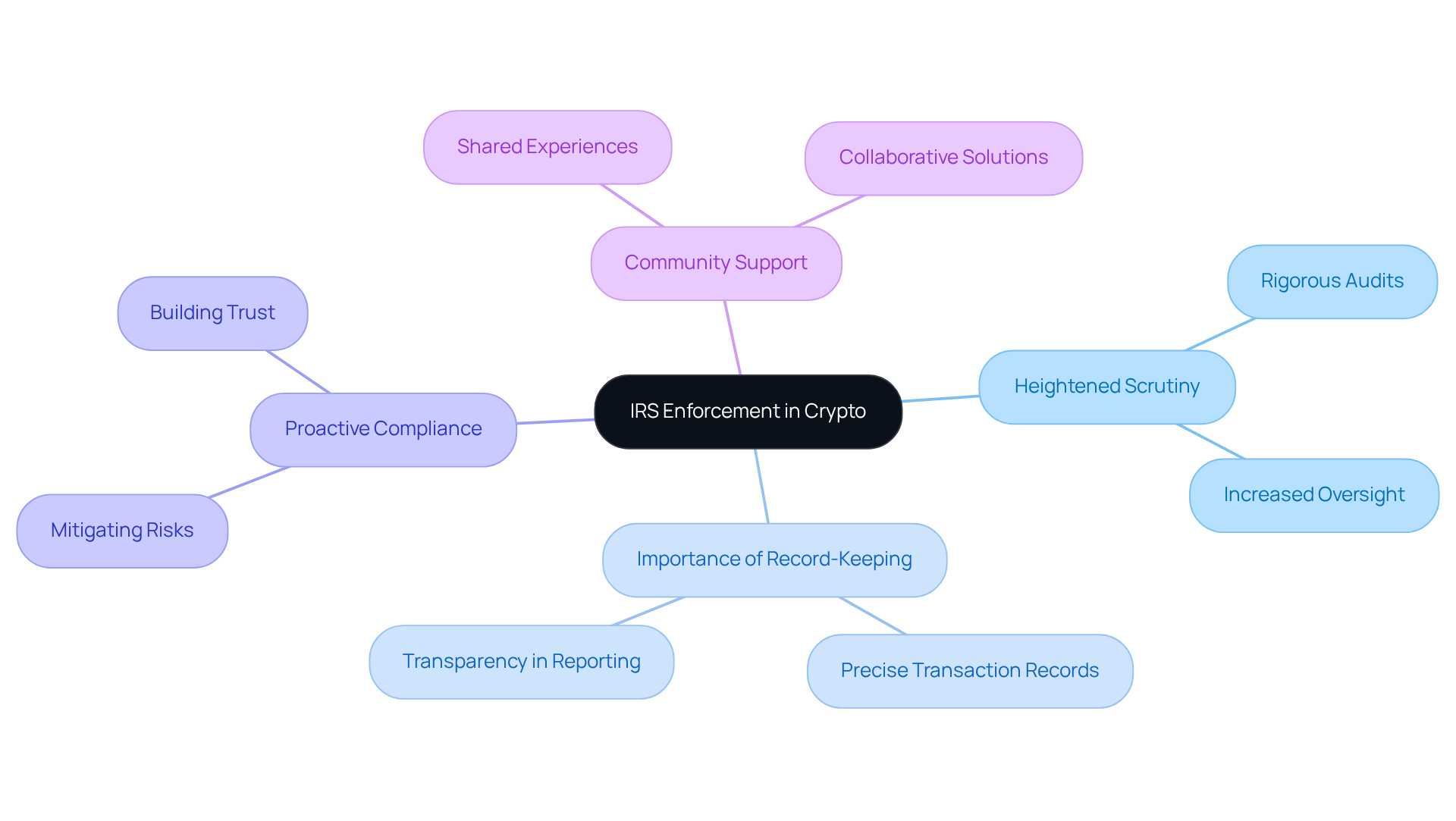

IRS Enforcement in Crypto: Understanding the New Landscape

The IRS has significantly increased its enforcement efforts in the cryptocurrency space, which can understandably cause concern for many businesses. This means that, in 2025, you may face more rigorous audits and oversight than ever before. Imagine the stress of navigating these complexities without proper preparation.

It’s crucial to keep precise records of all your cryptocurrency transactions and to be transparent when reporting your income. By taking a proactive approach to compliance, you can not only mitigate risks but also position your startup as a trustworthy player in the market.

Remember, you’re not alone in this journey; many others are facing similar challenges, and together we can find the best path forward.

Conclusion

The landscape of digital finance is experiencing a transformative shift, a reality that many of you may find daunting. The pivotal events in the cryptocurrency sector are not just headlines; they represent challenges that can feel overwhelming as we look toward 2025. Yet, within these challenges lie opportunities for growth and innovation. Embracing regulatory clarity, innovative branding strategies, and evolving tax rules is essential for navigating the complexities of the digital currency market and securing a competitive edge.

We understand that effective branding, compliance with new regulations, and grasping tax implications are crucial for success in this dynamic environment. The Senate's cryptocurrency bill offers a framework that could foster innovation, while the White House's advocacy for a pro-innovation environment highlights the importance of collaboration between public and private sectors. Moreover, being aware of taxable events and the implications of crypto staking rewards will be vital for sustaining growth and building trust with consumers.

As we look ahead, the cryptocurrency landscape is rich with potential for those willing to adapt and engage. By actively participating in key funding events and forming strategic partnerships, startups can not only enhance their visibility but also contribute to a thriving community. We believe that as the digital finance ecosystem continues to evolve, staying informed and proactive will empower you to navigate these changes confidently, ensuring a brighter future in the world of cryptocurrency. Together, we can face these challenges and emerge stronger, fostering a supportive community that thrives on collaboration and innovation.

Frequently Asked Questions

What challenges do cryptocurrency startups face in digital branding?

Cryptocurrency startups often struggle to stand out in a competitive landscape, making it difficult to create distinctive brand identities.

How does RNO1 assist cryptocurrency ventures?

RNO1 helps cryptocurrency ventures by utilizing advanced UX design, SEO strategies, and performance marketing techniques to create unique brands that resonate with their audience.

What innovative subscription models does RNO1 offer?

RNO1 offers subscription models like Revolve and Ryde, providing ongoing support that helps startups adapt to market changes and shifting consumer preferences.

Why are effective UX design and strong SEO strategies important in the crypto sector?

Effective UX design and strong SEO strategies are crucial for improving user engagement and building trust, which are key factors for success in the digital currency sector.

What recent changes have been made in Senate cryptocurrency legislation?

The new Senate cryptocurrency legislation aims to clarify the legal status of various digital assets, helping businesses navigate the complexities of the market.

What is the significance of understanding the distinction between securities and commodities in the new legislation?

Understanding the distinction between securities and commodities is essential as it can reduce uncertainty and foster innovation within the cryptocurrency sector.

What risks should new ventures be aware of in the cryptocurrency market?

New ventures should be cautious of speculative investments and pump-and-dump schemes that pose significant risks in the cryptocurrency market.

What does the White House report advocate for in the cryptocurrency sector?

The White House report advocates for fostering a pro-innovation environment to ensure that the U.S. remains competitive in the global digital economy.

How can partnerships benefit cryptocurrency startups?

Partnerships with established brands can enhance credibility, attract investment, and help startups scale their operations and improve their online experiences.

What should cryptocurrency companies focus on to thrive in the evolving landscape?

Cryptocurrency companies should adapt their strategies in response to regulatory changes, embrace partnerships, and leverage available support to foster growth and innovation.